Equities

Apple removed from Goldman Sachs' conviction list over stock underperformance, concerns linger

Apple Removed from Goldman's Top Buys Amid iPhone Demand Concerns, Still Rated Buy

By Barry Stearns

ᐧ

Key Takeaway

- Apple Inc. was removed from Goldman Sachs' conviction list due to stock underperformance and concerns over weak iPhone demand.

- Despite the removal, analyst Michael Ng maintains a buy rating, highlighting the strength of Apple's ecosystem.

- Apple's stock dropped by 0.6% following the announcement, reflecting market skepticism about its near-term growth prospects.

Concerns Over Apple's Performance

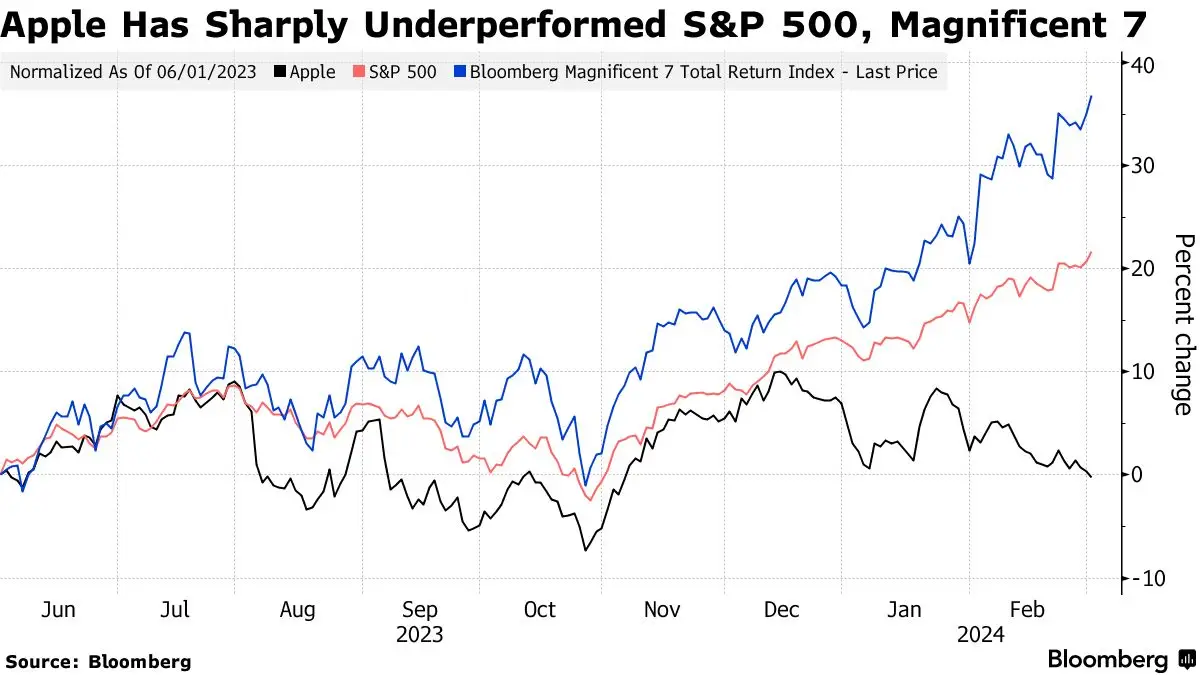

Apple Inc. faced a setback as it was removed from Goldman Sachs Group Inc.'s list of top buys due to underperformance in its stock. The tech giant had been part of Goldman's conviction list since June but failed to keep up with the S&P 500 Index, with its share price remaining relatively stagnant. The concerns stem from worries about weak demand for Apple's key products, particularly the iPhone, amidst ongoing economic challenges in China.

"Apple's removal from our list is a reflection of the current market conditions and our assessment of its investment potential," stated analyst Michael Ng, who still maintains a buy rating on Apple. He believes that despite the focus on slower product revenue growth, the strength of the Apple ecosystem and its revenue durability should not be overlooked.

Performance Comparison

Apple's stock dropped by 0.6% following its removal from Goldman's top buys list. The company's performance has been notably lower compared to its Magnificent 7 peers, with only Tesla Inc. trailing behind. The concerns surrounding a potential prolonged slump in iPhone sales have contributed to the stock's underperformance.

Goldman's monthly review process for its Directors' Cut list ensures that stocks are continuously evaluated based on their investment potential. Apple's removal indicates a shift in the market sentiment towards the company's growth prospects and competitive positioning.

Analyst's Perspective

Analyst Michael Ng's buy rating on Apple underscores his confidence in the company's long-term prospects despite the current challenges. He emphasizes the resilience of the Apple ecosystem and the visibility of its revenue streams, suggesting that the market may be overlooking the company's underlying strengths amidst short-term concerns.

Street Views

- Michael Ng, Goldman Sachs (Bullish on Apple):

"The market’s focus on slower product revenue growth masks the strength of the Apple ecosystem and associated revenue durability & visibility."

Finance GPT

beta