Macro

Cash Outshines Bonds with 14% Decade Return

Cash and Bonds Offer Comparable Decade Returns; Rate-Cut Delays Boost Cash Appeal with 5.4% Yields

By Max Weldon

ᐧ

Key Takeaway

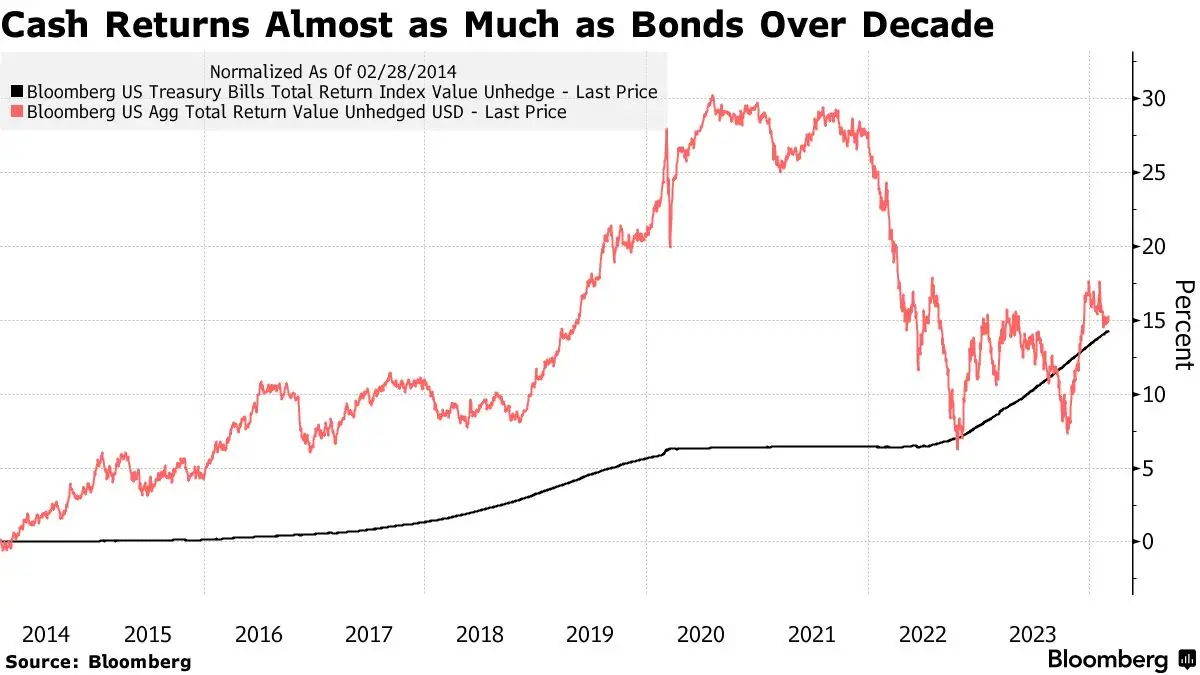

- Cash and T-bills have outperformed bonds over the last decade, with a notable 14% return compared to bonds' 15%.

- Investors are delaying moves to longer-duration bonds as cash yields 5.4%, over 100 basis points above the 10-year bond yield.

- The shift in investment preference towards cash is underscored by $1 trillion flowing into money-market funds last year, pushing assets above $6 trillion.

Navigating the Cash Versus Bonds Conundrum in Today's Financial Terrain

In the intricate dance of investment, the spotlight has recently shifted towards a pivotal decision confronting investors: the choice between the safety of cash and the allure of longer-duration bonds. This dilemma is underscored by the performance of the Bloomberg US Aggregate Index, which tracks Treasuries and investment-grade corporate debt. Over the last decade, this index has eked out a modest 15% return, barely edging past the 14% garnered from Treasury bills, traditionally seen as cash equivalents. This near parity in returns is particularly striking, given the bond market's tumultuous journey in 2022, marred by significant losses triggered by the Federal Reserve's aggressive rate hikes.

The current financial landscape paints a compelling picture for cash, especially in the short term. With three-month bills offering yields around 5.4%, a clear 100 basis points above their 10-year counterparts, and with expectations for Fed rate cuts being deferred, cash emerges as the more enticing option. This scenario is vividly illustrated by William Eigen of the JPMorgan Strategic Income Opportunities Fund, who has strategically positioned approximately 60% of his fund in cash. Eigen's approach mirrors a broader sentiment among investors, driven by the immediate, attractive returns on cash in the prevailing rate environment. "I’ve never been paid so much in my career to do so little," Eigen's statement encapsulates the lucrative nature of cash investments today. This cautious stance is further validated by the surge in money-market funds, which witnessed an influx of over $1 trillion last year, propelling total assets beyond the $6 trillion mark for the first time.

However, the bond market is not without its advocates. Ed Al-Hussainy from Columbia Threadneedle Investments points to a silver lining. With the Fed hinting at a rate peak, the risk-reward dynamics for cash may be on the cusp of a shift. Al-Hussainy argues that bonds, now yielding more than double what they did two years ago, offer a "much nicer buffer" against potential capital losses. This optimism is rooted in the belief that bonds have sufficient cushion to absorb losses, with 10-year yields needing to ascend approximately 60 basis points to 4.8% just to neutralize annual coupon income. This analysis suggests a potential inflection point where extending duration in bonds could become more appealing for investors with a longer-term outlook.

The evolving narrative in the US equities and sectors presents a complex tableau for active investors. The juxtaposition of cash's immediate allure against the prospective long-term benefits of bonds encapsulates the nuanced decision-making process investors must navigate. As the financial landscape continues to evolve, the strategic choices made today will undoubtedly shape the investment outcomes of tomorrow.

Street Views

William Eigen, JPMorgan (Neutral on the bond market):

"I’ve never been paid so much in my career to do so little."

Ed Al-Hussainy, Columbia Threadneedle Investments (Bullish on bonds over cash):

"The marginal risk attached to the dollar invested in a cash fund today is very different... Your reinvestment risk here is materially higher. Extending duration makes a lot of sense." "You’re starting with yields that are much higher. It gives you a much nicer buffer."

Finance GPT

beta