Equities

Is Ferrari NV's Valuation Justified? Analyst Downgrades Stock to Sell

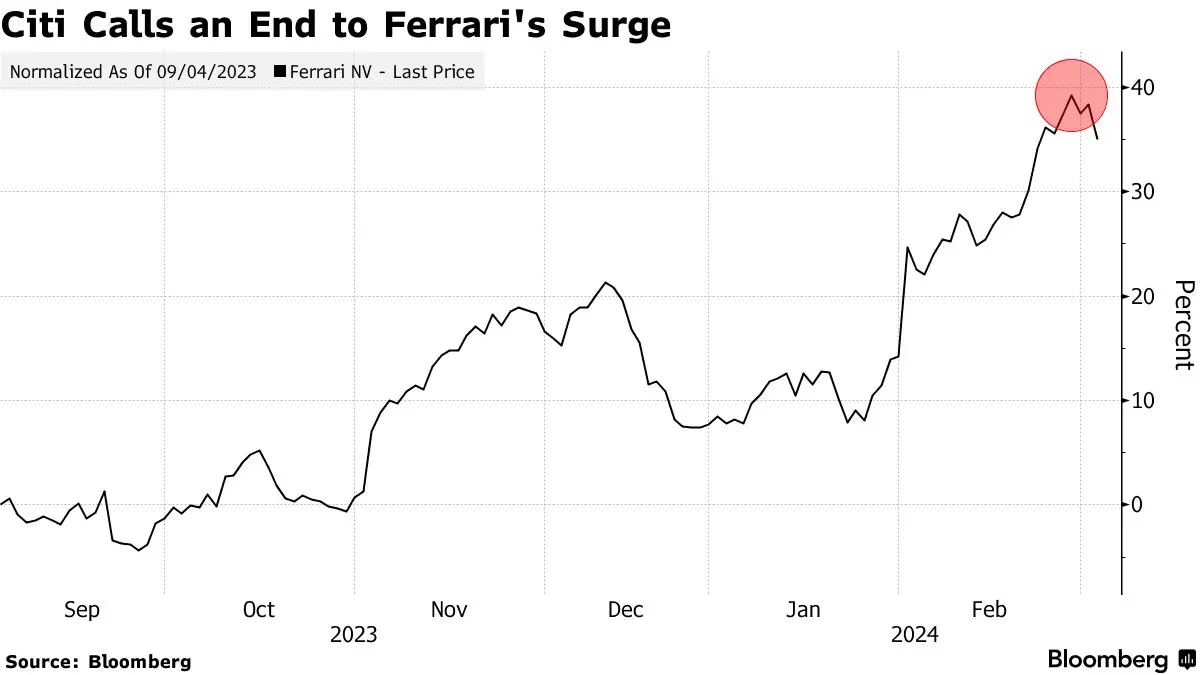

Citi downgrades Ferrari to sell on valuation concerns, despite a 25% surge in shares and long-term growth potential.

By Barry Stearns

ᐧ

Key Takeaway

- Citi downgrades Ferrari NV to sell, citing "rich valuation" with shares trading at 12 times sales and 57 times estimated 2024 earnings.

- This rare sell rating contrasts with the majority of analysts' buy or hold recommendations, highlighting concerns over Ferrari's current market valuation.

- Despite near-term valuation challenges, Ferrari's long-term quality and growth prospects are acknowledged, suggesting potential for future investor interest.

Valuation Concerns

Ferrari NV, the luxury supercar manufacturer, faced a downgrade from Citigroup Inc. analyst Harald Hendrikse, shifting the rating from neutral to sell. This decision was driven by concerns over the stock's "rich valuation," with Ferrari's shares having surged by 25% this year, reaching record highs and extending last year's 52% increase. Despite the majority of analysts maintaining buy or hold ratings, Hendrikse highlighted that Ferrari's shares are trading at 12 times sales and 57 times estimated 2024 earnings, valuations he considers stretched. This marks the first time he has issued a sell rating on the stock since initiating coverage in September.

"Still, Hendrikse acknowledges Ferrari's quality and long-term growth potential, conceding that his timing on the recommendation could be off," he stated. With the current market landscape favoring "quality" stocks, there remains a possibility for Ferrari to continue its upward trajectory, as noted by Hendrikse.

Analyst Perspective

Harald Hendrikse's sell rating on Ferrari stands out as a rare move among analysts covering the luxury car manufacturer. While the majority of analysts maintain buy or hold recommendations, Hendrikse's concerns about the stock's valuation and the potential for further growth in the current market environment provide a unique perspective on Ferrari's future performance.

Market Response

Following the sell rating from Citigroup, Ferrari's stock may face increased scrutiny from investors and market participants. The stock's recent strong performance, coupled with the valuation concerns raised by Hendrikse, could lead to heightened volatility and trading activity as investors reassess their positions in light of this new information.

Long-Term Prospects

Despite the sell rating, Hendrikse's acknowledgment of Ferrari's quality and growth prospects suggests that the company's long-term outlook remains positive. While the stock may face near-term challenges based on valuation considerations, the underlying strength of the brand and potential for future growth could still attract investors looking for exposure to the luxury car market.

Street Views

- Harald Hendrikse, Citigroup Inc. (Bearish on Ferrari NV):

"Struggles to justify the stock’s 'rich valuation'... Ferrari’s strength has led to the shares trading at 12 times sales and 57 times estimated 2024 earnings, multiples he views as a stretch."

Finance GPT

beta