Macro

S&P 500 Targets 5,400: Tech Titans Lead Charge

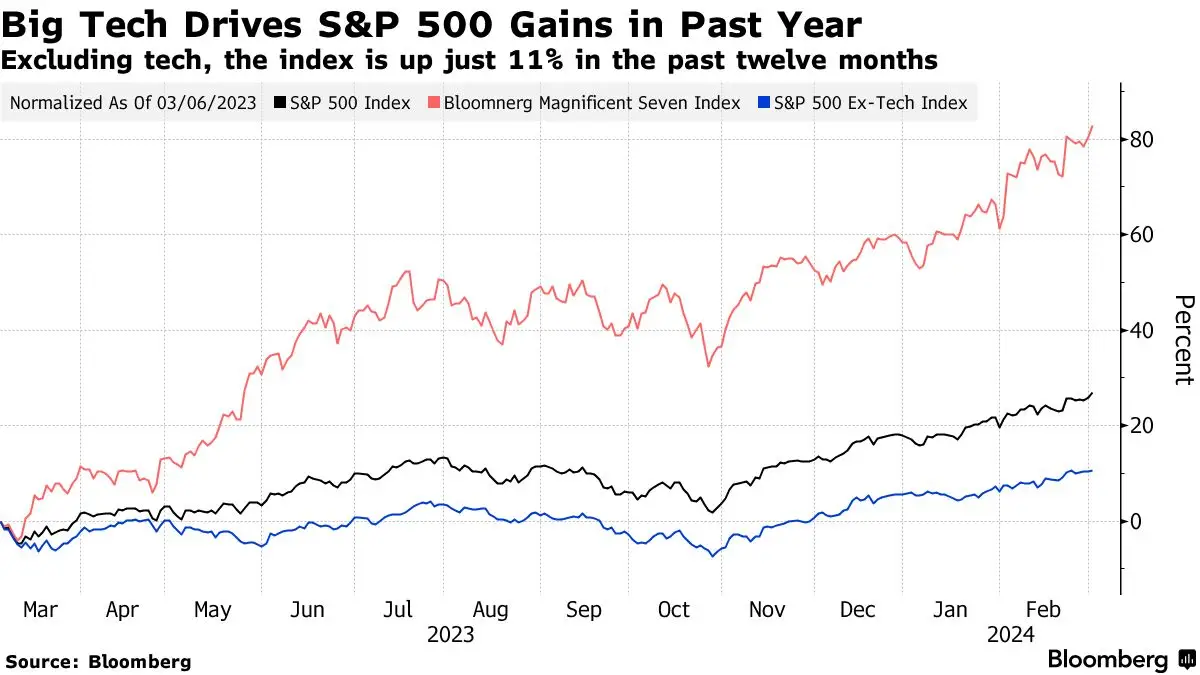

Tech Titans Drive S&P 500 Surge, Marking a Rally Grounded in Solid Fundamentals Unlike Past Bubbles

By Bill Bullington

ᐧ

Key Takeaway

- Goldman Sachs strategists argue the current Big Tech-led S&P 500 rally, driven by "Magnificent 7," doesn't mirror past bubbles due to more contained "extreme valuations."

- The enterprise value-to-sales ratio of stocks above 10 has decreased from 35% during the tech bubble to 24%, indicating a narrower breadth of high valuations.

- Bank of America's Savita Subramanian raises S&P 500 forecast to 5,400 points, reflecting confidence in strong earnings growth and profit margin resilience.

The Tech Titans Propel the S&P 500 to New Heights

In a remarkable display of market strength, the S&P 500 has soared to unprecedented levels, largely thanks to the extraordinary performance of a handful of technology behemoths. These companies, affectionately dubbed the Magnificent Seven—Apple Inc., Microsoft Corp., Nvidia Inc., Amazon.com Inc., Meta Platforms Inc., Alphabet Inc., and Tesla Inc.—have not only captivated the market's imagination but have also significantly contributed to the index's surge. This phenomenon, increasingly fueled by the burgeoning excitement around artificial intelligence, has led market strategists to reassess their outlooks for the benchmark index, painting a picture of a market teeming with optimism and growth potential.

David Kostin, a strategist at Goldman Sachs Group Inc., has pointed out the unique nature of the current market landscape. Unlike the speculative bubbles of the past, today's market is characterized by a concentrated valuation in these leading growth stocks—a situation Kostin believes is firmly grounded in their solid fundamentals. This discernment marks a departure from the previous "growth at any cost" mentality, signaling a more mature and perhaps more sustainable market dynamic.

A Wave of Optimism Sweeps Through Wall Street

The tech-led rally has not only reshaped market dynamics but has also infused Wall Street with a renewed sense of optimism. Savita Subramanian, a strategist at Bank of America Corp., has revised her S&P 500 target upwards to 5,400 points from an initial 5,000, indicating a potential 5% increase from current levels. This adjustment reflects a growing confidence in the market's direction, buoyed by stronger-than-expected earnings growth and a resilience in profit margins that many had not anticipated.

Echoing this sentiment, John Stoltzfus of Oppenheimer Asset Management underscores the solid foundation underpinning the market's upward trajectory. He points to robust business activity, consumer spending, and job growth as critical factors fueling the rally. This confluence of positive indicators suggests that the market's ascent may not only continue but could also broaden, encompassing a wider array of sectors beyond the tech giants.

A Healthier Market Dynamic Emerges

The current rally distinguishes itself from previous market euphorias through a more judicious valuation approach. The enterprise value-to-sales ratio for stocks with valuations above 10 now represents 24% of the total US equity market capitalization. This is a noticeable decrease from 28% in 2021 and significantly lower than the 35% observed during the tech bubble. Such a shift indicates a narrowing in the breadth of "extreme valuations," pointing towards a market that is not only more selective but also potentially more resilient to speculative excesses.

This evolving market dynamic suggests a healthier environment that could support the continuation of the rally longer than many might expect. As the Magnificent Seven continue to lead the charge, their influence on the market's direction is undeniable. However, the underlying strength of the broader economy, coupled with a more discerning approach to valuation, provides a solid foundation for this optimism. As we move forward, the interplay between technological innovation and economic fundamentals will likely remain a central theme, shaping the trajectory of US equities and sectors in the months to come.

Street Views

David Kostin, Goldman Sachs Group Inc. (Neutral on the S&P 500 and technology stocks):

"This time is different... Unlike the broad-based ‘growth at any cost’ in 2021, investors are mostly paying high valuations for the largest growth stocks in the index. We believe the valuation of the Magnificent 7 is currently supported by their fundamentals."

Savita Subramanian, Bank of America Corp. (Bullish on S&P 500):

"Her target is now among the highest on Wall Street, and is based on bullish signals around stronger earnings growth and ‘surprising’ profit margin resilience."

John Stoltzfus, Oppenheimer Asset Management (Bullish on stock market rally):

"The bullish momentum is driven by fundamentals that are ‘too strong to argue against’ and are reflected in data showing resilience in business, consumer spending and jobs growth... There’s likely room for a further broadening of this year’s stock market rally and opportunity to see equities further climb the proverbial wall of worry."

Finance GPT

beta