Equities

US Defence Contractors Struggle Amidst Legislative Gridlock and Budget Uncertainty

US defense contractors lag in global military boom amid Washington's budget gridlock and potential policy shifts with Trump's re-election.

By Barry Stearns

ᐧ

Key Takeaway

- US defence contractors like Lockheed Martin and RTX see shares drop 10% and 9%, while European peers like Leonardo and Rheinmetall surge 91% and 78%.

- Legislative gridlock in Washington, with a frozen 2024 budget, hampers US military stocks despite a $508bn order book backlog.

- Concerns over Trump's potential re-election add to the sector's uncertainty, affecting NATO commitments and American defence exports.

US Defence Contractors Struggle

US defence contractors are facing challenges amidst a global military boom that has seen their European counterparts' share prices soar while legislative gridlock in Washington hampers government spending certainty. Shares of major US military contractors like Lockheed Martin and RTX have declined by 10% and 9% respectively over the past year, in stark contrast to the 91% jump in Leonardo's shares from Italy and the 78% rally in Rheinmetall's shares from Germany.

Byron Callan from Capital Alpha Partners highlighted the chaotic environment in Washington due to the frozen 2024 budget, causing uncertainty and holding back US defence companies' valuations despite record order books. The backlog for the leading six groups increased by 9% to $508bn last year.

Budget Uncertainty Looms

The US Congress has until March 22nd to pass the 2024 defence budget, with a stop-gap budget in place to avoid a government shutdown. The Pentagon's 2025 budget request is imminent, but ongoing programmes are slowing down due to the budget impasse. The undersecretaries of the Army, Navy, and Air Force have warned of the negative impact on military modernization efforts if a defence spending bill is not passed.

Gabe Camarillo, Army under secretary, emphasized the halt in production rate increases and new starts for acquisition and military construction projects under the current budget constraints. The Biden administration's additional spending package for Ukraine, including $20bn to replenish US weapons stocks, is also on hold.

Trump's Re-Election Concerns

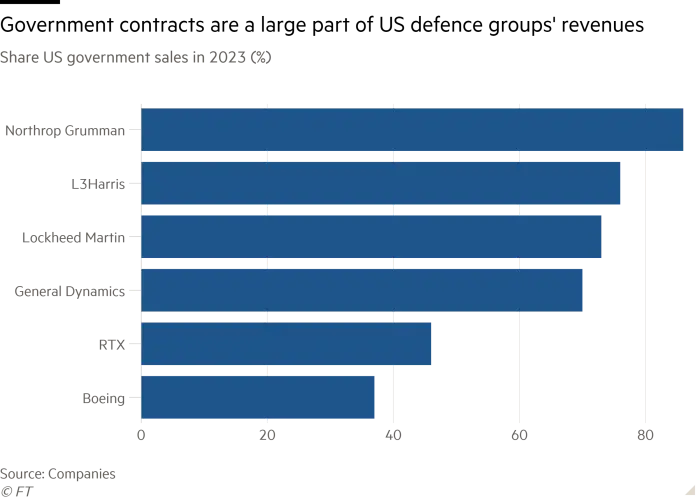

The US defence sector faces further uncertainty if Donald Trump is re-elected as president, potentially leading to weaker commitments to NATO and dampening American defence exports. European governments may redirect spending to domestic contractors, impacting US companies heavily reliant on government contracts.

Robert Stallard from Vertical Research Partners highlighted concerns over fixed-price contracts, with rising costs leading to significant charges for companies like Northrop Grumman. Boeing reported losses in its defence business due to fixed-price contracts, prompting executives to reconsider bidding on risky contracts to prioritize earnings and cash flow.

Street Views

Byron Callan, Capital Alpha Partners (Neutral on US defense contractors):

"I’ve never seen anything like this, the chaos. It’s really a very chaotic environment in Washington right now."

Robert Stallard, Vertical Research Partners (Bearish on the defense sector's contract management):

"The 'monster' charge has reawakened worries that the defence sector signed up for more risk than was prudent."

Management Quotes

Gabe Camarillo, Army under secretary:

"These are production rate increases, new starts — both in programmes for acquisition as well as military construction projects that we cannot start."

Chris Kubasik, CEO of L3Harris:

"I will sacrifice revenue for earnings and cash every day of the year, and we will continue to do so until that changes."

Finance GPT

beta