Equities

Broadcom's Q1 Revenue Misses Expectations, AI Demand to Drive Growth

Broadcom's Q1 revenue hits $7.39B, missing expectations, but AI growth and strong software sales brighten outlook.

By Bill Bullington

ᐧ

Key Takeaway

- Broadcom's Q1 revenue of $7.39 billion missed expectations due to slow chip sales, yet profit exceeded forecasts with $10.99 per share.

- AI demand is projected to fuel growth, expected to constitute 35% of semiconductor revenue in fiscal 2024.

- Despite a post-earnings stock dip, strategic acquisitions and diversification into software signal strong future growth potential.

Sluggish Semiconductor Sales

Broadcom Inc., a major chip supplier for tech giants like Apple Inc., reported revenue of $7.39 billion in the fiscal first quarter, falling short of analysts' expectations of $7.7 billion. The company faced slower sales in segments like telecommunications, impacting its chip business. Despite this, Broadcom remains on track to achieve $50 billion in sales for fiscal 2024, in line with its previous forecast.

AI Fueling Growth

CEO Hock Tan highlighted that artificial intelligence spending is expected to drive further growth for Broadcom this year. The company anticipates AI demand to contribute to 35% of its semiconductor revenue in fiscal 2024, up from the initial forecast of 25%. Tan emphasized strong demand for networking products from AI data centers and cloud computing providers, boosting growth in the semiconductor segment.

Financial Performance

Broadcom's profit for the first quarter stood at $10.99 per share, surpassing analysts' predictions of $10.42 per share. Total revenue increased by 34% to $11.96 billion, exceeding the average analyst estimate of $11.8 billion. The infrastructure software division outperformed expectations with revenue of $4.57 billion, compared to the projected $4.33 billion.

Market Response and Future Outlook

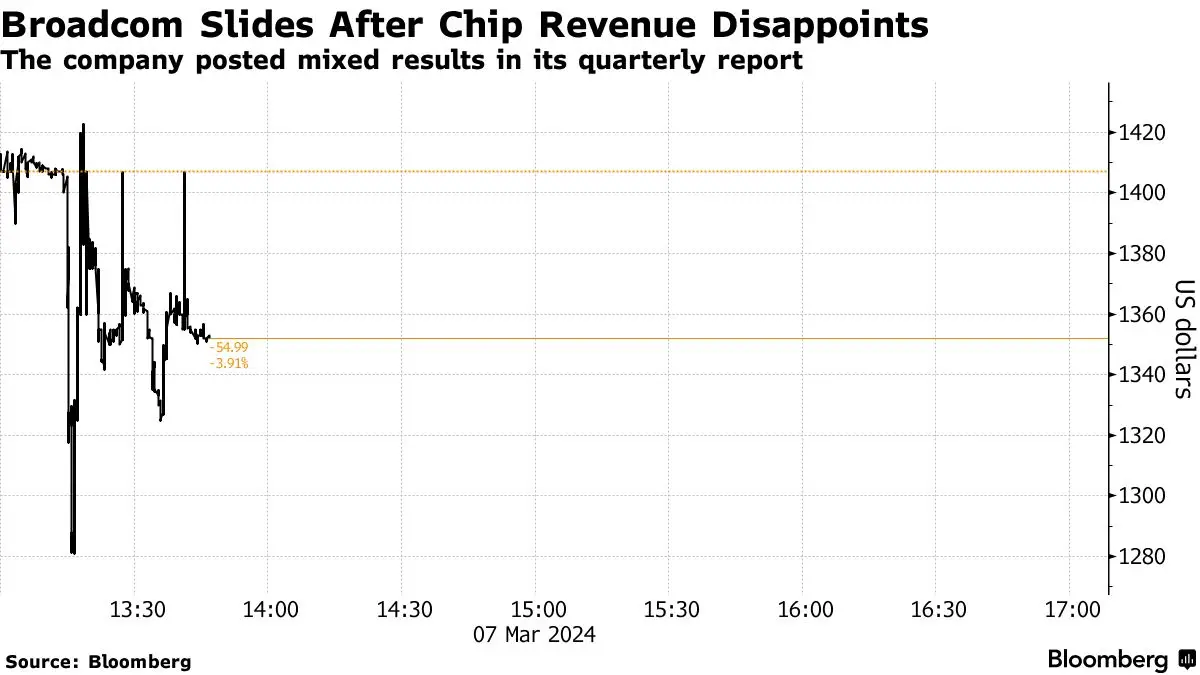

Following the earnings announcement, Broadcom's stock dipped about 1% in extended trading, despite a 26% increase earlier in the year. The company's integration and restructuring of the VMware acquisition have led to the suspension of quarterly projections. CEO Tan's strategic acquisitions and diversification efforts, including the move into software, are positioning Broadcom for future growth opportunities.

Management Quotes

- Hock Tan, CEO of Broadcom:

"AI spending would fuel further growth this year... demand to account for 35% of its semiconductor revenue in fiscal 2024, up from a previous forecast of 25%." "Demand was strong for our networking products from AI data centers and large cloud computing providers were clamoring for our custom artificial intelligence chips. They are driving growth in our semiconductor segment."

Finance GPT

beta