Crypto

Spot Bitcoin ETFs Surge, Attracting Billions in Inflows

BlackRock and Fidelity's spot bitcoin ETFs outperform Grayscale with over $14 billion in inflows, driving Bitcoin to record highs.

By Bill Bullington

ᐧ

Key Takeaway

- BlackRock's iShares Bitcoin Trust and Fidelity's Wise Origin Bitcoin Fund attracted more inflows than Grayscale's outflows, signaling strong institutional interest in spot bitcoin ETFs.

- BlackRock and Fidelity offer significantly lower expense ratios compared to Grayscale, enhancing their attractiveness to investors.

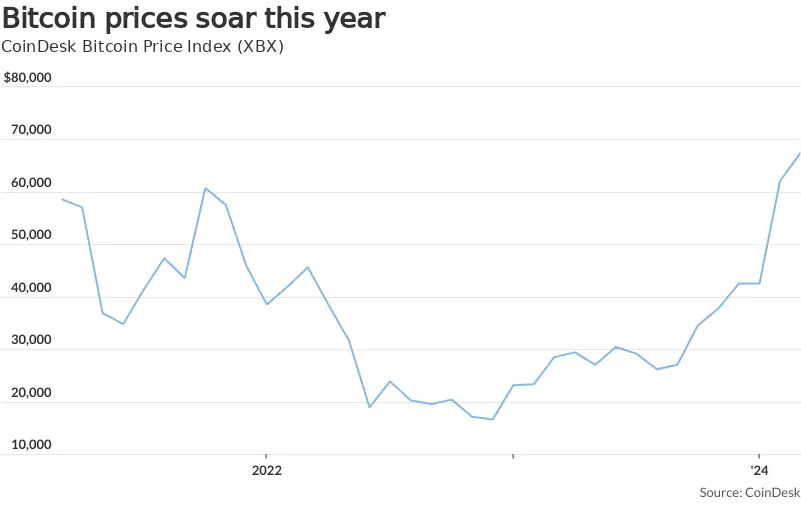

- The approval of spot bitcoin ETFs has contributed to a significant rally in bitcoin prices, with major funds posting gains over 43% since their listings.

Inflows and Outflows in Bitcoin ETFs

BlackRock and Fidelity have seen significant inflows into their exchange-traded funds tracking spot bitcoin prices, surpassing the outflows from Grayscale's bitcoin ETF, as per Deutsche Bank Research. Jim Reid from Deutsche Bank notes that Bitcoin is increasingly institutionalized, regardless of one's stance on its valuation.

Inflow Leaders

Since the launch of spot bitcoin ETFs in January, BlackRock's iShares Bitcoin Trust IBIT has attracted over $9 billion in inflows, followed by Fidelity's Wise Origin Bitcoin Fund FBTC with more than $5 billion. In contrast, the Grayscale Bitcoin Trust ETF GBTC has experienced $9.5 billion in outflows during the same period.

Fee Comparison

Grayscale's Bitcoin Trust ETF has an expense ratio of 1.5%, costing $15 annually for every $1,000 invested. In comparison, BlackRock's iShares Bitcoin Trust has a lower fee of 0.25%, with a temporary waiver reducing it to 0.12% for the first $5 billion in assets. Fidelity's Bitcoin ETF also has a 0.25% fee, currently waived until July 31.

Performance and Market Impact

Spot bitcoin ETFs have surged post-listing, with the iShares Bitcoin Trust, Fidelity Wise Origin Bitcoin Fund, and ARK 21Shares Bitcoin ETF all showing significant gains. Bitcoin prices hit an intraday record high of around $69,000 earlier this week, driven by the SEC's approval of spot bitcoin ETFs on Jan. 10.

Street Views

- Jim Reid, Deutsche Bank (Neutral on Bitcoin):

"Whether you’re a cynic or a convert, whether you think it’s cheap or in a bubble, what’s clear is that Bitcoin is becoming increasingly institutionalised."

Finance GPT

beta