Crypto

Bitcoin Eyes $80,000 Amid Record Inflows, ETF Buzz

Bitcoin nears all-time high of $72,881, with $2.7 billion inflow and ETF launches driving record rally.

By Bill Bullington

ᐧ

Key Takeaway

- Bitcoin nears all-time high of $72,881 amid $2.7 billion inflow into crypto last week, with significant interest in spot Bitcoin ETFs.

- Institutional adoption in the US and upcoming halving event fuel optimism for potential rise towards $80,000.

- Asian stocks related to digital assets also gain, reflecting a bullish mood in the broader cryptocurrency market.

Bitcoin's Record-Breaking Rally

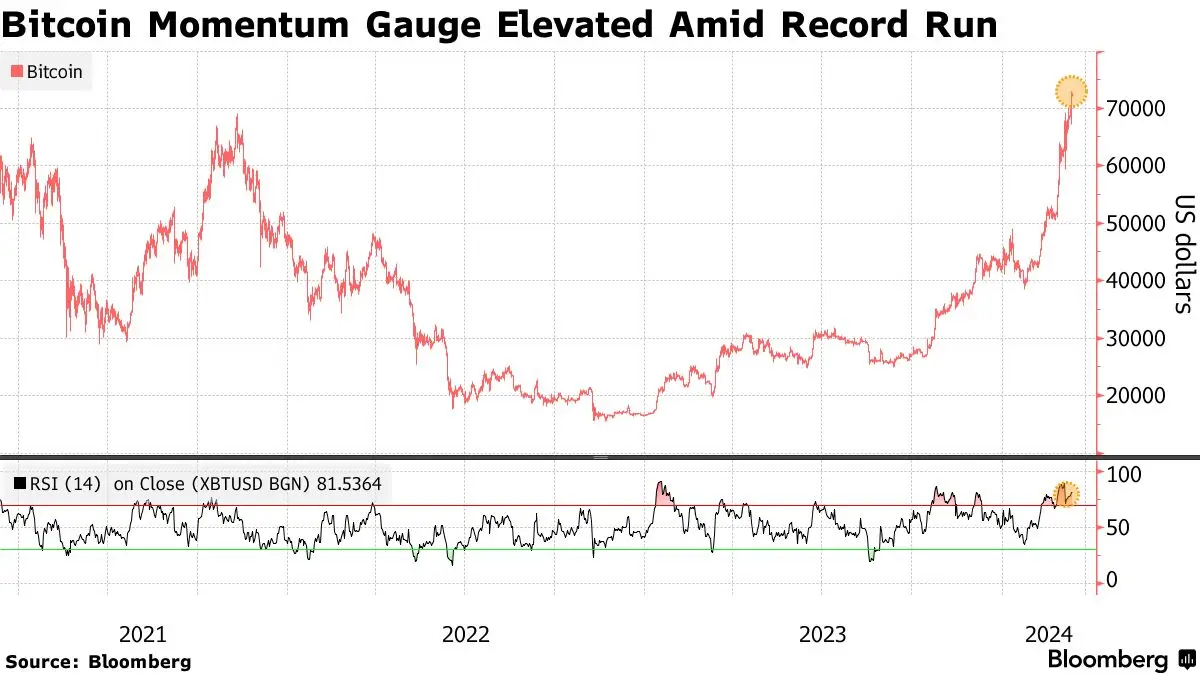

Bitcoin has been on a remarkable run, reaching an all-time high of nearly $72,881 on Monday, with its price hovering around $72,165 as of Tuesday morning in Singapore. This surge is part of a broader trend that has seen the cryptocurrency and the top 100 coins increase by approximately 70% this year. The influx of a record $2.7 billion into crypto assets last week, predominantly into Bitcoin, underscores the growing investor confidence and capital flow into the digital currency space.

Institutional Adoption and ETFs Fueling Growth

The launch of spot Bitcoin exchange-traded funds (ETFs) in the US on January 11 has been a significant catalyst for Bitcoin's recent momentum. These ETFs, introduced by financial giants such as BlackRock Inc. and Fidelity Investments, have attracted about $9.5 billion in net inflows so far. The UK's London Stock Exchange and Thailand's securities regulator have also shown openness to crypto ETFs, indicating a global trend towards institutional adoption. Ophelia Snyder, co-founder and president of 21Shares, highlighted the early stages of institutional adoption in the US, pointing to a structural shift in the Bitcoin market towards more US-centric trading hours.

Analysts Eye Further Gains Amidst Halving Event

With Bitcoin's rally, approximately 1,500 new "millionaire wallets" are being created daily, though this pace is slower compared to the 2021 bull run. Analysts like Tony Sycamore of IG Australia Pty and Katie Stockton of Fairlead Strategies LLC are optimistic, projecting potential pushes towards the $80,000 mark in the coming months. The anticipation of Bitcoin's halving event next month, which will reduce the supply of new Bitcoin by half, coupled with expectations of looser monetary policy, is fueling bullish sentiments among investors.

Street Views

Ophelia Snyder, 21Shares (Bullish on Bitcoin):

"We are seeing institutional adoption in the US... It’s quite early still. Not all of the institutions, not all of the wire houses, have access to it."

Tony Sycamore, IG Australia Pty (Bullish on Bitcoin):

"Bitcoin is expected to be well-supported on dips by those looking to position for a push toward $80,000 in the months ahead."

Katie Stockton, Fairlead Strategies LLC (Bullish on Bitcoin):

"$80,000 is within reach in the medium term."

Finance GPT

beta