Macro

Turkey's Gold Smuggling Hits Record Amid Economic Turmoil

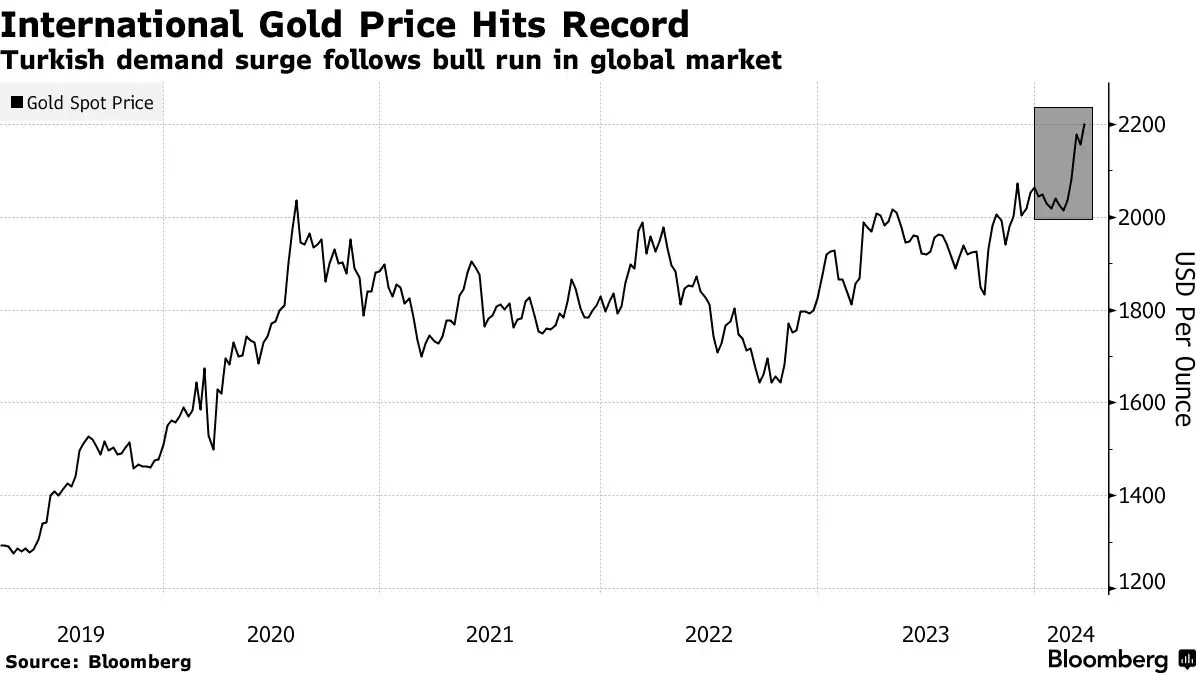

Turkey's gold smuggling soars with 350kg seized this year, driven by a 7% premium and high demand amidst economic instability.

By Mackenzie Crow

ᐧ

Key Takeaway

- Turkey's gold smuggling surges due to a 7% premium over international prices, with 350 kilograms seized this year.

- A government-imposed quota system on bullion imports has exacerbated the supply squeeze, driving local premiums higher.

- The Turkish State Mint is doubling production efforts to meet soaring demand amid economic instability and political uncertainty.

Surge in Gold Smuggling

Turkey is witnessing a significant increase in gold smuggling, with security forces seizing about 350 kilograms of smuggled gold at border crossings so far this year. This figure already surpasses 60% of the total gold seized in the entirety of 2023. A notable incident involved the discovery of 88 kilograms of gold bars, valued over $6 million, hidden under the car seats in the eastern province of Van, near the Iranian border. The premium on gold in Turkey, approximately 7% above international markets, or $5,000 per kilogram, is enticing for organized criminals and opportunistic individuals alike.

Demand Drives Premium

The underlying cause of the smuggling surge is a significant premium on gold within Turkey, driven by a combination of high retail demand and a state-imposed cap on gold imports. Turks traditionally use gold as a hedge against economic instability, such as the recent period of weakening currency and spiraling inflation under President Recep Tayyip Erdogan's unorthodox monetary policies. The government's quota system for bullion imports, aimed at narrowing the current account deficit, has further exacerbated the supply squeeze, pushing local premiums higher. Despite these restrictions, demand remains strong, fueled by negative real interest rates, persistent inflation, and political uncertainty.

Government and Market Response

In response to the soaring demand, the Turkish State Mint is operating double shifts, seven days a week, to produce "Republic Gold" coins, with daily output nearly doubled to 700-800 kilograms. However, the Vice-President of the Istanbul Jewelers, Goldsmiths, and Moneychangers Association, Mehmet Ali Yildirimturk, notes a bullish market outlook with very few sellers, indicating a continued price surge due to high demand from small-scale buyers. Meanwhile, Turkey's gold imports have slumped for the fourth consecutive month due to government restrictions, despite domestic demand soaring, as reflected in the disparity between local and international gold prices.

Economic Pressures and Policy Implications

The surge in gold smuggling and the premium on gold in Turkey are symptomatic of broader economic challenges, including inflationary pressures and currency devaluation. Investors are calling for interest rate hikes as inflation spikes, the lira weakens, and foreign reserves dwindle. The central bank, under new guidance, has signaled a willingness to tighten policy if inflation outlook deteriorates significantly. The ongoing monetary policy tightening and the state-imposed quota on gold imports are attempts to stabilize the economy, but they also highlight the challenges of managing demand for gold as a traditional safe-haven asset.

Management Quotes

Mehmet Hekim, Deputy General Director of the Turkish State Mint:

"The Turkish State Mint that has a monopoly on the production of standardized “Republic Gold” coins is working double shifts through to 1 a.m. seven days a week to meet citizens’ demand... It’s almost doubled its daily output in recent weeks to 700-800 kilograms as of Wednesday."

Mehmet Ali Yildirimturk, Vice-President of Istanbul Jewelers, Goldsmiths and Moneychangers Association:

"These days there are almost no sellers. When there’s lots of these small-scale buyers it creates demand and the price explodes."

Finance GPT

beta