Equities

Global Public Equity Supply Contracts Rapidly Amid Buyback Preference

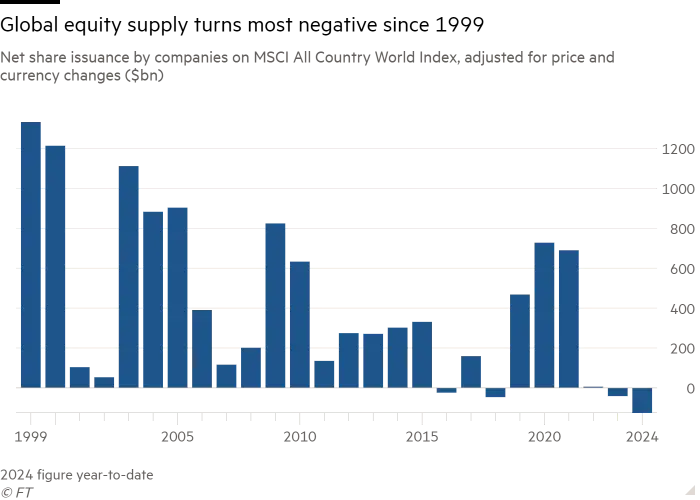

Global public equity supply contracts by $120 billion, marking a significant shift as companies favor buybacks over IPOs.

By Barry Stearns

ᐧ

Key Takeaway

- Global public equity supply contracts by $120 billion this year, marking the fastest pace in over two decades.

- Despite economic growth, companies prefer buybacks over issuing new shares, with $1.2 trillion projected in buybacks.

- IPO market underperforms amid uncertainties, with Reddit's IPO being a rare highlight in a cautious market environment.

Shrinking Public Equity Supply

The global supply of public equity is experiencing its most rapid contraction in over two decades, with a net decrease of $120 billion this year alone, surpassing last year's total reduction of $40 billion. This trend, highlighted by JPMorgan analysts, marks a significant shift in the market dynamics, indicating a potential third consecutive year of decline in the availability of public equities. Despite expectations of economic growth and rising stock markets, which theoretically should encourage companies to issue new shares, the reality has been quite different. Companies continue to favor buybacks, with projections suggesting a continuation of this trend at a pace similar to the past three years, potentially reaching about $1.2 trillion by the end of the year. Initial public offerings (IPOs) and other share sales, however, have not met forecasts, reflecting a "persistent uncertainty" among global companies, according to JPMorgan's Nikolaos Panigirtzoglou.

IPO Market and Buyback Trends

The IPO market has notably underperformed expectations this year, with significant anticipation around the US market's potential to avoid a recession not materializing into increased equity offerings. This hesitancy is attributed to concerns over potential inflation spikes driven by strong economic growth, leading to a cautious stance among executives. The recent IPO of Reddit, which was priced at the top end of its range, raising a total of $519 million for the company and an additional $229 million for existing shareholders, stands out as a rare high-profile public debut in an otherwise subdued market. This event has sparked some optimism for future listings, though many company owners remain wary of proceeding with IPOs due to uncertainties surrounding interest rates and the upcoming US presidential election.

Decline in Listed Companies

The number of listed companies in the US has seen a significant decrease, dropping from over 7,000 to fewer than 4,000 since the year 2000. A similar trend is observed in Europe and the UK, where the market for public equities is contracting. This reduction in the number of public companies is partly due to smaller firms opting for private markets or venture capital funding to avoid the financial and regulatory burdens of going public. The growth of private equity and the challenges associated with sales growth have also contributed to this trend, with companies finding it easier to boost earnings per share through buybacks rather than expanding their sales.

Street Views

Nikolaos Panigirtzoglou, JPMorgan (Neutral on the global supply of public equity):

"The two 'puzzling' trends reflected 'persistent uncertainty' among companies around the world... This suggests some people do not think we are out of the woods."

David McGrath, Oakworth Capital Bank (Neutral on company growth strategies):

"You don’t have nearly as many companies going public because of the growth of private equity... We’ve also got to a point where it’s become harder for companies to grow sales. If you want to boost earnings per share, it’s easier to make the denominator smaller by buying back stock."

Finance GPT

beta