Markets Wrap

Peso's 20-Year High Against Real: A Fragile Triumph?

Mexican Peso's 20-year high against Brazilian Real faces potential reversal amid crowded trades and global market shifts.

By Athena Xu

ᐧ

Key Takeaway

- Mexican peso hits a 20-year high against the Brazilian real, but faces potential reversal amid crowded trades and US economic data.

- Global markets brace for US inflation data and ECB decisions, with Treasury yields peaking and stocks like Tesla, Amazon showing gains.

- International focus on South Africa's port legal challenge and Ukraine's debt restructuring underscores geopolitical and economic complexities.

Mexican Peso and Brazilian Real: A Macro Perspective

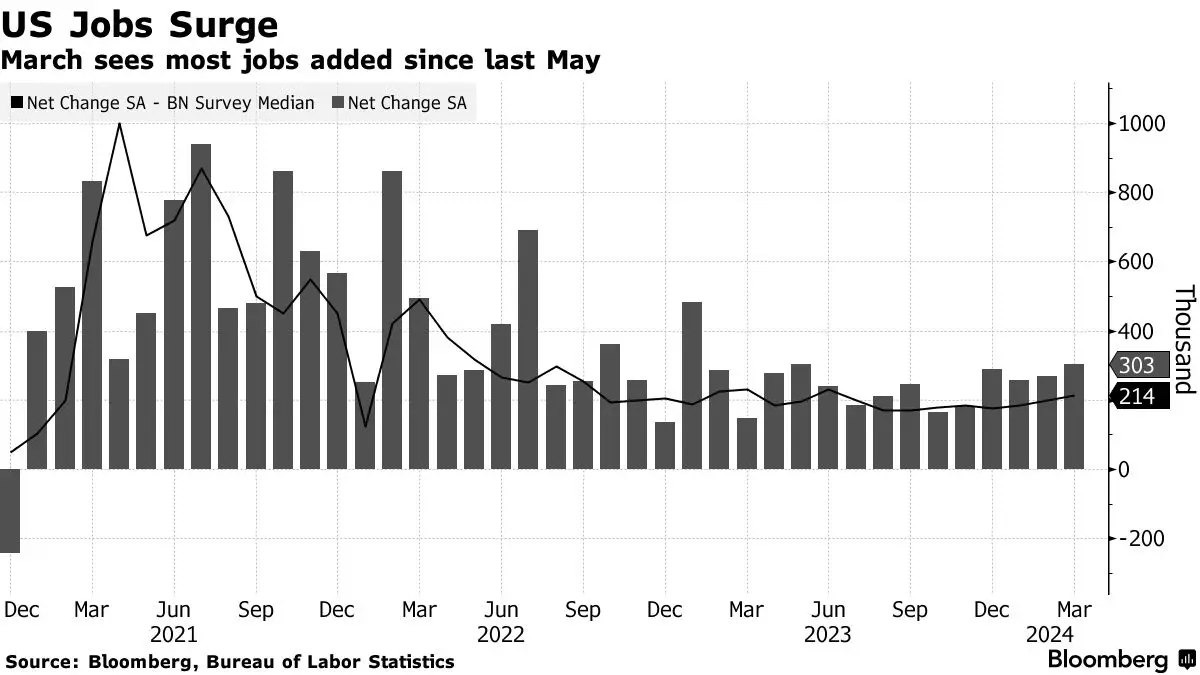

The Mexican peso's remarkable ascent against the Brazilian real, marking a 20-year high, has been one of the standout macro trades in recent years. However, this trend appears to have accelerated too quickly, raising concerns about a potential dramatic reversal. Despite the absence of immediate threats, the latter half of the year could introduce factors that challenge the peso's dominance. The Mexican peso's performance, particularly against the US dollar, has been impressive, boasting a Sharpe ratio of 2.5% this year. This strength was further bolstered by US payroll data, which led to a surge in the peso. However, the trade has become increasingly crowded, and the peso is now susceptible to negative surprises or hawkish data from the US that could prompt traders to scale back on Federal Reserve rate cut bets.

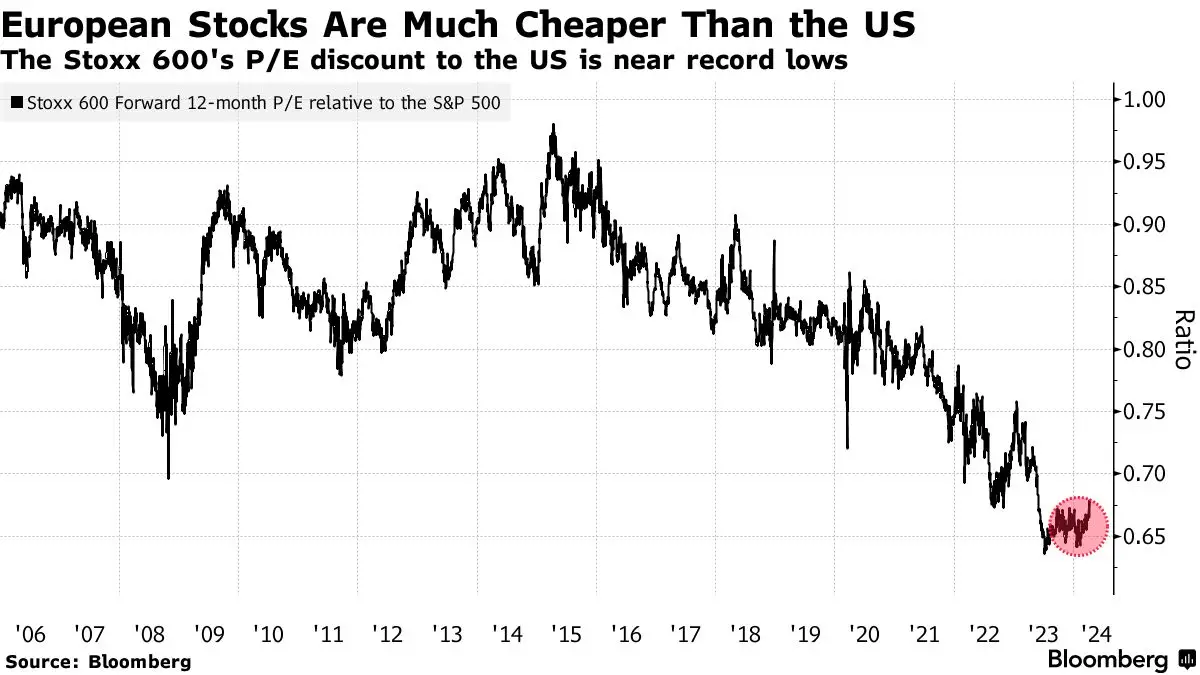

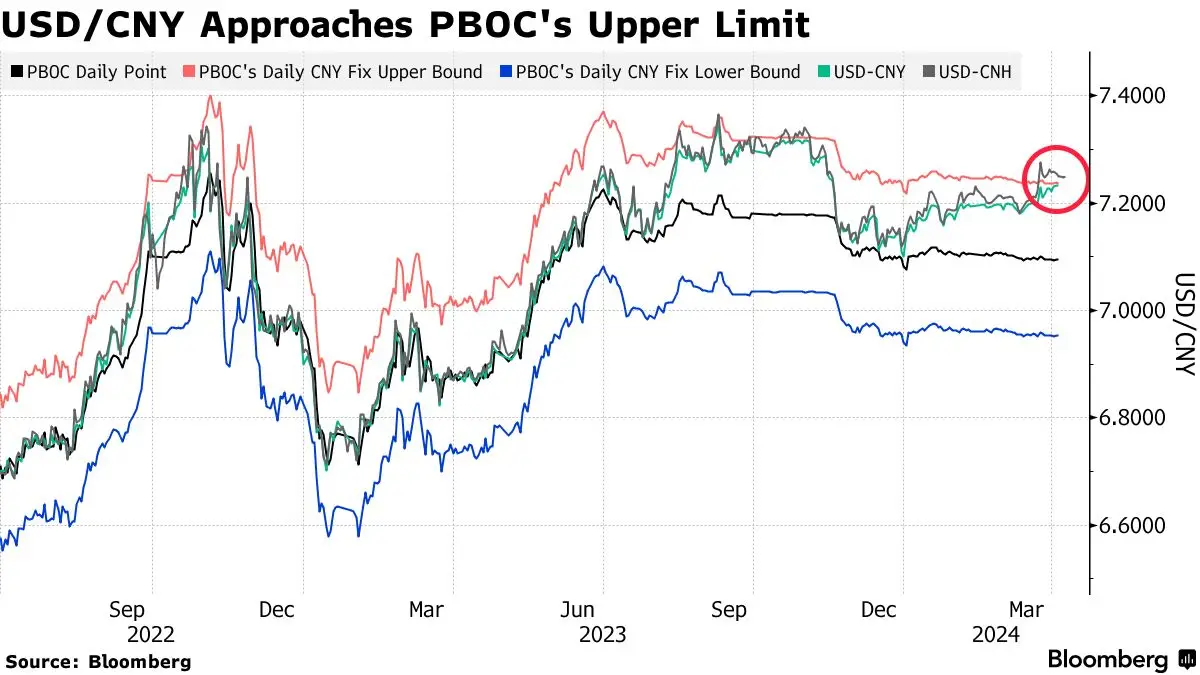

The technical indicators, such as the 14-day relative strength index (RSI) and the breach of the upper Bollinger band, suggest that while the MXN/BRL pair's advance may slow, a significant retreat is not immediately on the horizon. Yet, the looming threats of central bank easing, political risks, particularly from the US presidential election, and China's economic performance could disrupt this trend. Mexico's central bank has initiated a rate-cutting cycle, and inflation-linked bond yield curves indicate that Mexico's real interest rates could fall below Brazil's in the future. Additionally, Mexico's exposure to the US market contrasts with Brazil's significant reliance on China, making Brazil more vulnerable to shifts in the Chinese economy.

Global Market Dynamics: Bonds, Stocks, and Inflation

Global bonds have experienced a downturn, while stock markets have shown modest movements as traders adjust their expectations for interest rate cuts in light of resilient US economic indicators. Treasury yields have reached their highest levels this year, with interest rate swaps suggesting two Federal Reserve rate cuts as the most probable scenario. The anticipation for upcoming US inflation data and decisions from the European Central Bank, coupled with the start of the first-quarter earnings season, has investors on edge. The strong US jobs report supports the Federal Reserve's cautious stance on rate reductions, with the upcoming consumer price figures expected to provide further evidence of inflation's gradual cooling.

Equity Markets and Corporate Earnings Outlook

Equity markets have responded positively to the strength of the economy and corporate earnings. The S&P 500 and Nasdaq 100 have shown significant gains, buoyed by optimism over US corporate earnings. High-profile companies like Tesla and Amazon have seen notable movements in their stock prices, reflecting broader market sentiment. The upcoming corporate earnings season, with reports from major banks, will be a critical period for assessing the health of the US economy and the potential impact on market trends.

International Developments: South Africa's Port Operations and Ukraine's Debt Restructuring

Internationally, A.P. Moller - Maersk is challenging a decision by South Africa's Transnet to partner with International Container Terminal Services Inc. for the development of the Durban Container Terminal. This legal challenge highlights the complexities of enhancing state-owned enterprise performance through private sector involvement. Meanwhile, Ukraine is facing the prospect of debt restructuring as a freeze on bond repayments is set to expire. The formation of a creditor committee and discussions with eurobond holders will be crucial for Ukraine's financial stability and its ability to attract future investment for reconstruction efforts.

Finance GPT

beta