Equities

Tianrui Cement Shares Plunge 99%, Trading Halted Amid Crisis

China Tianrui Group Cement Co. faces a 99% stock plunge, highlighting the volatility in Chinese firms amid a housing crisis.

By Jack Wilson

ᐧ

Key Takeaway

- China Tianrui Group Cement Co. shares crashed 99% in 15 minutes, halting trading and highlighting volatility in Chinese markets.

- The company's financial woes reflect a broader crisis, with a net loss of $87.7 million amid China's housing slump.

- Country Garden Holdings faces severe liquidity issues, with sales dropping 83%, underscoring the deepening property market crisis in China.

Trading Suspension and Market Shock

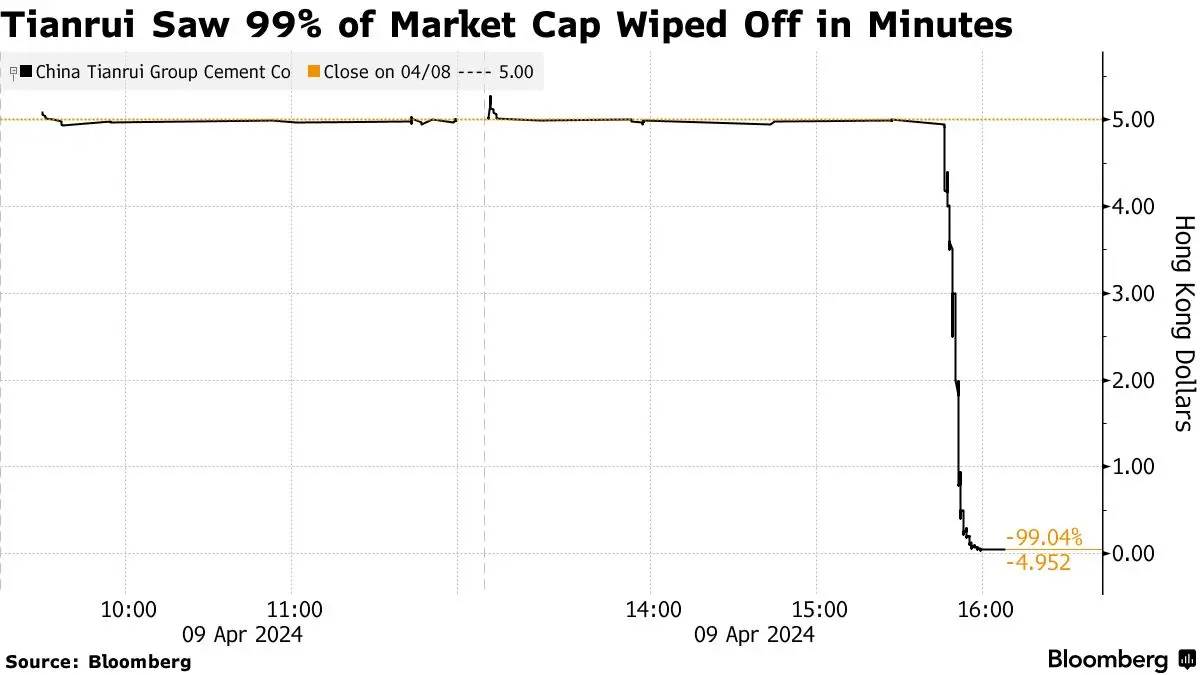

China Tianrui Group Cement Co., a prominent cement producer based in Henan province, experienced a dramatic selloff that led to the suspension of its stock trading on the Hong Kong exchange. The company's shares plummeted by 99% to about HK$0.05, erasing nearly all its market value and reducing its market capitalization to HK$141 million ($18 million). This abrupt decline occurred in the final 15 minutes of trading, with approximately 281 million shares, or a third of the company's free float, changing hands. Over 80 million of these shares were traded during the closing auction. The trading halt was announced pending a disclosure related to inside information, as per an exchange filing. This event underscores the volatility and risks associated with certain Chinese firms, particularly those with high shareholding concentration and those engaging in financing practices like using shares as collateral for loans.

Financial Struggles Amid Housing Crisis

Tianrui's financial difficulties have been exacerbated by an unprecedented housing crisis in China, affecting property developers and construction firms. The company reported a net loss of 634 million yuan ($87.7 million) last year, a stark contrast to the profit of 449 million yuan in 2022. This downturn was attributed to weak demand stemming from the property market slump, increased competition, and rising raw material costs. Tianrui, which has an annual cement output capacity of about 58 million tons, has been a key supplier for major infrastructure projects, including high-speed rail lines. However, the current market conditions have posed significant challenges to its operations.

Country Garden's Deepening Crisis

Parallel to Tianrui's troubles, Country Garden Holdings Co. has faced a severe financial downturn, with home sales plummeting by 83% to 4.3 billion yuan ($590 million) last month. This decline is part of a broader crisis in China's property market, which has seen no signs of recovery. Country Garden's financial woes include a trading suspension in Hong Kong and distressed dollar bonds. The company has engaged KPMG for offshore liability restructuring and formed an ad-hoc creditor group, indicating efforts to navigate through liquidity challenges. Despite these measures, the developer's financial instability remains a significant concern, with a wind-up petition filed in a Hong Kong court.

Regulatory and Market Challenges

The Chinese property sector's downturn has been a major drag on the country's GDP, with developers like Country Garden and China Evergrande Group at the center of the crisis. The government's attempts to stabilize the market have yet to show substantial results, leaving many residential projects unfinished and affecting urban China's wealth. Country Garden's restructuring efforts and the financial turmoil faced by Tianrui Group Cement Co. highlight the broader challenges within China's real estate and construction sectors, raising concerns over potential social unrest and the need for regulatory intervention.

Finance GPT

beta