Macro

Nasdaq Surges Despite Gross Warning, Defies Fed Pivot Expectation

Nasdaq rallies despite warnings, as mixed economic signals and tech's AI-driven earnings defy market predictions.

By Athena Xu

ᐧ

Key Takeaway

- Despite Bill Gross's caution on tech stocks, Nasdaq surged after strong AI earnings from Microsoft and Alphabet.

- Mixed economic data and unexpected market resilience highlight the difficulty in predicting short-term movements, emphasizing diversification.

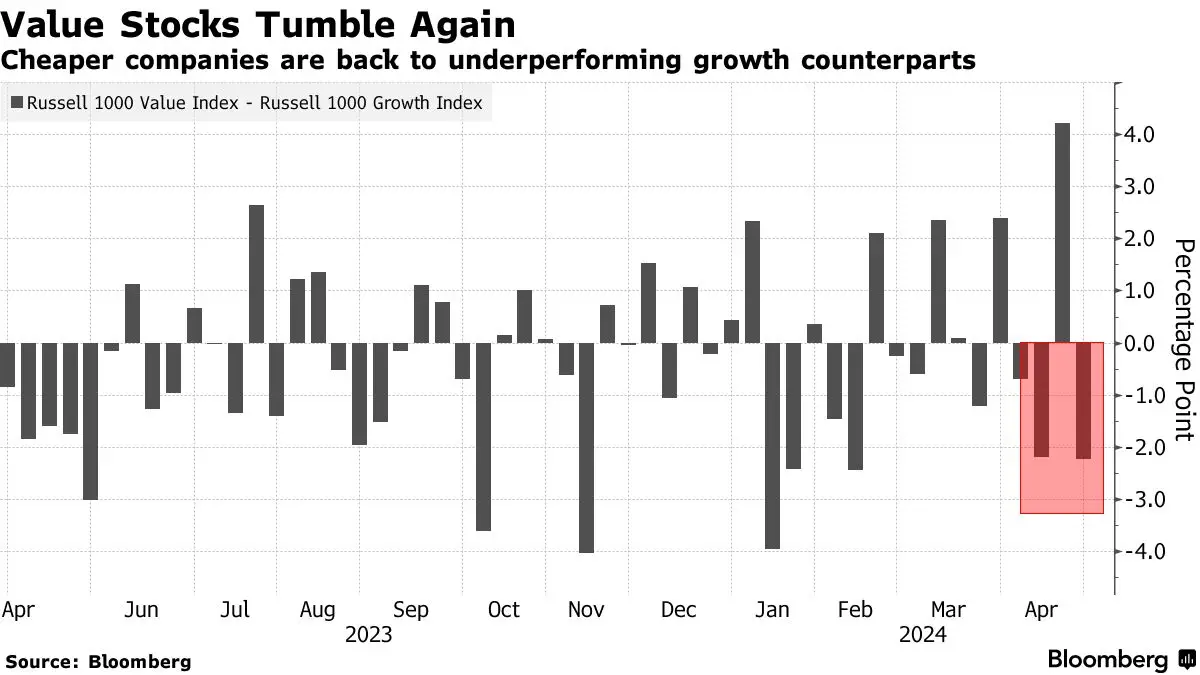

- Recent market trends defy Fed pivot expectations, with growth stocks outperforming value amid high bond yields.

Market Whiplash Amid Economic Signals

The financial markets experienced a significant whiplash this week, underscored by the Nasdaq Composite Index's best session since February, despite Bill Gross's cautionary stance against tech stocks. Gross, the co-founder of Pacific Investment Management, advised investors to "stick to value stocks" and "avoid tech for now" due to rising inflation and economic growth concerns. Contrary to his warning, tech giants like Microsoft Corp. and Alphabet Inc. demonstrated robust AI-driven earnings, propelling the Nasdaq upwards. This juxtaposition highlights the unpredictable nature of short-term market movements and the challenges in forecasting the impact of macroeconomic indicators on different sectors.

Economic Data Sends Mixed Signals

Recent economic reports have presented a complex picture, with growth slowing more than anticipated yet certain sectors showing resilience. Thursday's GDP report revealed a growth rate of only 1.6% alongside a core inflation rate of 3.7%, surprising analysts and investors alike. Despite these figures, strong personal spending data buoyed market optimism, even as it stoked inflationary concerns. The S&P 500 surged by more than 2.5% over the week, reflecting investors' willingness to bet on future profits despite the uncertain economic landscape. This mixed economic data underscores the difficulty in predicting market directions and the importance of diversification and hedging strategies, as noted by Chris Zaccarelli, chief investment officer at Independent Advisor Alliance.

Tech Sector Defies Expectations

The tech sector, particularly the Nasdaq 100, demonstrated remarkable resilience, bouncing back with a 4% gain after a previous 5.4% slide. This recovery was led by significant gains in major tech stocks, challenging the notion that higher yields would dampen growth in this sector. Investors' continued faith in tech, despite high valuations and the potential for increased interest rates, suggests a belief in the sector's long-term profitability. This week's market activity, including the substantial losses and gains among leading tech companies, illustrates the volatile nature of the tech sector and its potential for rapid recovery.

Street Views

Bill Gross, Pacific Investment Management co-founder (Neutral on the market):

"Stick to value stocks. Avoid tech for now."

Chris Zaccarelli, Independent Advisor Alliance (Neutral on the market):

"The recent spate of hotter-than-expected inflation data is throwing a wrench in most people’s models. It’s always difficult to spot inflection points in markets... It’s hard to be humble and admit that you don’t know which way things will go, so we have to talk about the importance of diversification and some tail risk hedges."

Tiffany Wilding, Pimco (Neutral on financial conditions):

"Tighter financial conditions are appropriate to cool a booming US economy... Based on recent comments, the Fed appears poised to deliver, by remaining on hold for longer. In other words, the pivot party is over."

Finance GPT

beta