Macro

Hedge Funds Cut Oil Bets Amid Weak US Data, Peso Volatility

Hedge funds cut bets on crude oil to a six-week low amid subdued US economic outlook and Mexican peso volatility.

By Barry Stearns

ᐧ

Key Takeaway

- Hedge funds cut bets on Brent and WTI crude, dropping to a six-week low amid subdued Middle East tensions and weak US economic data.

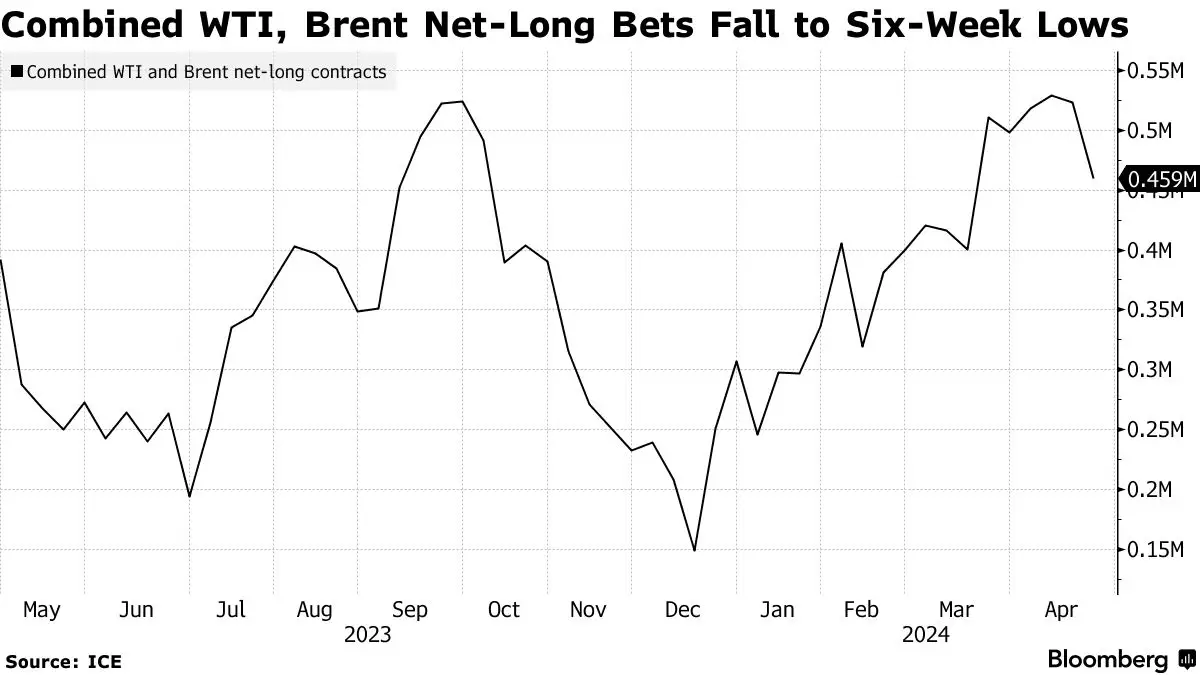

- Net-long positions decreased by 63,403 lots to 459,273 lots as geopolitical risks in oil markets diminished.

- Persistent US inflation suggests the Fed may keep interest rates high, affecting investor sentiment and restraining oil prices.

Crude Oil Positions Trimmed

Hedge funds have reduced their bets on Brent and West Texas Intermediate crude oil, marking a cautious stance in the commodities market. The net-long positions on these two grades were cut by 63,403 lots, bringing the total to 459,273 lots for the week ending April 23. This adjustment to positions reflects a six-week low, as reported by ICE Futures Europe and CFTC Futures data. Despite geopolitical tensions, including an Israeli strike on Iran, the impact on crude oil prices was mitigated as Iran’s media downplayed the attack, reducing the geopolitical risk premium traditionally associated with crude prices.

US Economic Data Weighs on Oil

Weak economic indicators from the United States have contributed to a subdued outlook for oil markets. Persistent inflation concerns suggest that the Federal Reserve may continue to maintain higher interest rates to combat price pressures. This economic backdrop has fostered a risk-off mood among investors, dampening enthusiasm for oil investments. Nonetheless, both WTI and Brent crude managed to post slight gains at the close of Friday’s session, indicating a complex interplay of factors influencing oil prices.

Mexican Peso Volatility

The Mexican peso experienced significant volatility, with hedge funds adjusting their positions in response to changing market dynamics. In a notable move, net long positions on the Mexican peso were reduced by 4,020 contracts, resulting in a total of 53,469 contracts. This adjustment, the largest since late February, coincided with a sharp decline in the peso's value, attributed to geopolitical tensions and a flash crash on April 19. Despite this, the peso has shown resilience, supported by factors such as high real interest rates and robust remittances from the United States.

Expert Insights on the Peso

Thierry Wizman, a director at Macquarie Futures, provided an analysis on the future trajectory of the Mexican peso. He suggested that while the peso may face some weakening against the dollar due to higher US interest rates, it is expected to perform better than other regional currencies like the Colombian peso or Brazilian real. The central bank's hawkish stance and the strength of remittances are anticipated to offer support to the peso, limiting its potential for significant weakening.

Finance GPT

beta