Macro

S&P Beats with 81% Companies Outperforming Amid Tech Surge

81% of S&P 500 companies beat earnings expectations, driving the index's best weekly gain since October 2023.

By Bill Bullington

ᐧ

Key Takeaway

- 81% of S&P 500 companies reporting so far have beaten expectations, potentially surpassing the 10-year average of 75%.

- Big Tech's earnings, especially from Alphabet Inc. and Microsoft Corp., boost market sentiment despite Meta Platforms Inc.'s underperformance.

- Despite macroeconomic challenges and geopolitical tensions, corporate America's strong profitability supports the S&P 500 amidst Federal Reserve rate cut speculations.

Earnings Season Surprises

The current quarterly reporting season has seen a significant number of S&P 500 companies outperforming Wall Street expectations. With about 230 firms reporting, an impressive 81% have surpassed analyst predictions, potentially setting a new benchmark against the 10-year average of 75%. High-profile companies like Alphabet Inc. and Microsoft Corp. have notably contributed to this positive trend, despite Meta Platforms Inc.'s less stellar performance. This earnings season is particularly noteworthy against a backdrop of macroeconomic challenges, including geopolitical tensions and diminished expectations for Federal Reserve interest rate cuts, which have pressured the S&P 500 down by almost 3% this month.

Tech Giants Propel Market

The technology sector has played a pivotal role in the market's dynamics, with significant movements observed in the stocks of the so-called Magnificent Seven. Alphabet Inc., Microsoft, and Tesla Inc. have all seen their shares move more than expected post-earnings, indicating a strong investor response to their financial results. This reaction underscores the market's underestimation of Big Tech's performance and sets a precedent for potential volatility in tech stocks reporting later in the season. The overall market sentiment has been buoyed by these results, contributing to a more than 1% gain in the S&P 500 and a notable 2.8% increase for the week, marking its best performance since late October 2023.

Margin Dynamics and Sector Performance

A key highlight from this earnings season is the recovery in S&P 500 margins, supported by a faster increase in consumer prices compared to producer prices, alongside corporate cost-cutting measures. This recovery is crucial for profitability and stock performance, with margins expected to improve further in the coming quarters. However, rising commodity prices pose a risk to this margin improvement, particularly in sectors like energy and materials, which are projected to see earnings contractions. Conversely, sectors such as communication services and information technology are expected to experience growth, highlighting the divergent sectoral performance within the broader market.

Banking Sector Outlook

Mixed results from major banks have painted a complex picture of the financial sector's health. While JPMorgan Chase & Co. and Wells Fargo & Co. have maintained conservative guidance, Goldman Sachs Group Inc. experienced a rally on its reporting day. The banking sector faces challenges with muted loan growth expectations and a projected 6% contraction in earnings per share year-over-year. Despite these headwinds, sentiment towards banks remains constructive, with reduced demand for hedging against losses in bank shares, indicating a cautious optimism for the sector's future.

Street Views

Scott Helfstein, Global X (Neutral on the market):

"At a time where expectations for corporate earnings were lofty, and we’ve already absorbed the fact the Federal Reserve isn’t going to cut seven times — those two things together have renewed debate over how bullish we should be. But in the end, that’s where I get back to that headline: corporate profitability has leveled up."

Don Nesbitt, ZCM (Bullish on stock picking opportunities):

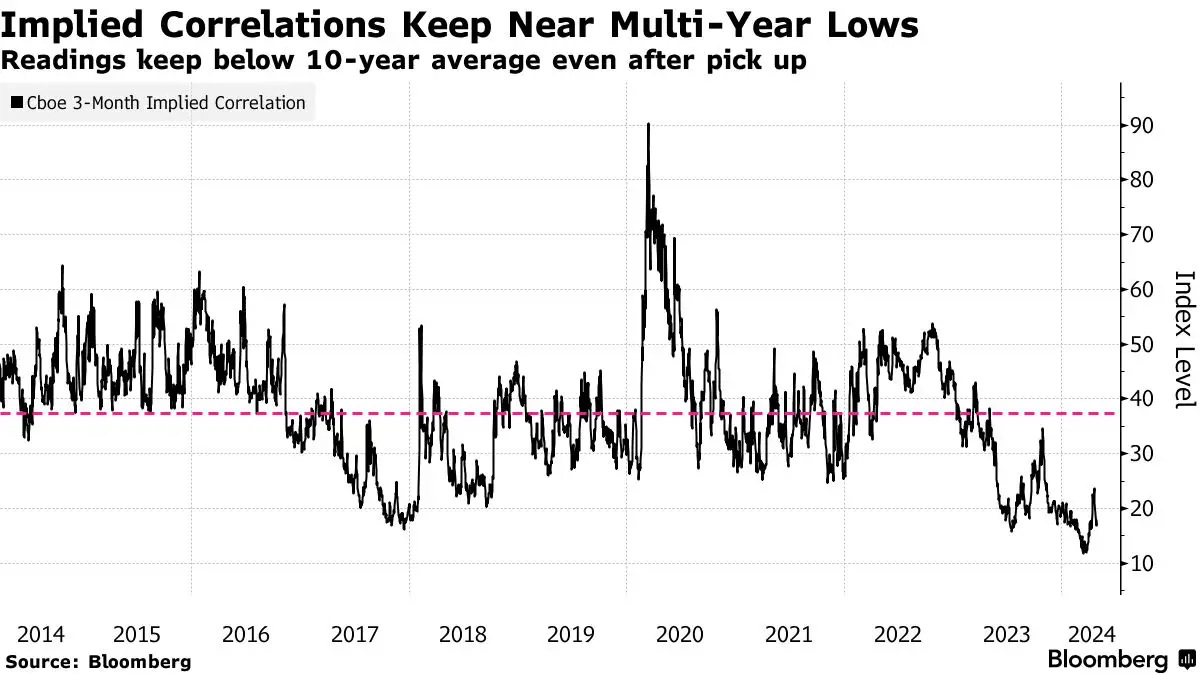

"When the correlations are high, it’s very difficult for active management. A low correlation is what you want for a stockpicker."

Stuart Kaiser, Citigroup Inc. (Neutral on Big Tech swings):

"There’s a chance that those later reporters have a lower likelihood of beating the implied move just because people have had a chance to reassess."

Gina Martin Adams, BI Chief Equity Strategist (Cautiously Optimistic on S&P 500 margins):

"Keep a close eye on margins... We saw signs of stabilization in the past year, but now rising commodity prices are eroding margin improvement for some sectors, which isn’t something that’s been embedded in analysts’ expectations."

Finance GPT

beta