Macro

OPEC+ Holds Firm on Oil Cuts Amid Market Flux

OPEC+ Maintains Production Cuts into Q2, Aiming for Market Stability Amid Uncertain Demand

By Mackenzie Crow

ᐧ

Key Takeaway

- OPEC+ extends oil-production cuts into Q2, signaling a cautious approach to restoring market volume amid demand uncertainty.

- Saudi Arabia's additional 1 million-barrel-a-day cut, on top of a previous 500,000 barrel cut, underscores OPEC+'s strategy for gradual supply restoration.

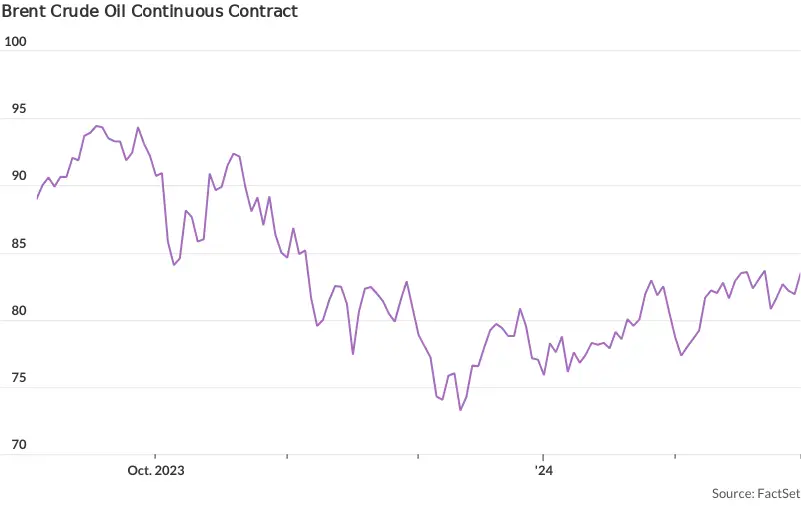

- Despite geopolitical tensions and production cuts, Brent and WTI crude prices remain significantly below their 52-week highs.

Navigating Through Uncertainty: OPEC+ Solidifies Its Strategy

In a move that underscores the delicate dance between supply management and market demand, OPEC+ has once again opted for prudence over haste. The coalition, led by the oil behemoth Saudi Arabia, has announced the extension of its voluntary production cuts into the second quarter of the year. This decision, which includes maintaining Saudi Arabia's significant reduction of 1 million barrels a day until the end of Q2, is a clear signal of the group's intent to cautiously navigate the murky waters of global oil demand.

Giacomo Romeo, a seasoned analyst from Jefferies, encapsulated the sentiment surrounding this decision, stating, "The decision sends a message of cohesion and confirms that the group is not in a hurry to return supply volumes, supporting the view of a gradual increase in supply as demand strengthens in Q3." This strategic patience exhibited by OPEC+ is not just about managing current market dynamics but also about positioning for future uncertainties.

The Market's Pulse

The ripple effects of OPEC+'s late November cuts have been palpable in the oil markets. Despite the geopolitical undercurrents threatening supply lines, notably the Israel-Hamas conflict, oil prices have managed a modest rebound. Yet, this recovery has not propelled prices back to their 2023 zeniths. As of the latest closing, May Brent crude settled at $83.55 a barrel on ICE Futures Europe, marking an 8.5% increase year-to-date but still trailing more than 13% behind its 52-week high. Similarly, May West Texas Intermediate crude found its footing at $79.97 on the NYMEX, climbing 11.6% in 2024, yet lagging 14.6% from its peak in the last 52 weeks.

Looking Ahead: A Balancing Act

The extension of production cuts by OPEC+ is a testament to the prevailing uncertainties shadowing the oil market. The group's cautious approach, while aiming to stabilize the market, also acknowledges the unpredictable demand landscape and the potential for gradual supply increments. The eyes of the world will be on the upcoming OPEC+ meeting in June, a pivotal moment that could set the tone for the future trajectory of oil prices and the efficacy of the coalition's strategy in navigating the complex interplay of global supply and demand dynamics.

In essence, OPEC+'s latest maneuver is a calculated step in a series of strategic moves aimed at fostering market stability. As we edge closer to the next meeting, the anticipation builds, not just among the member countries but also within the global community that watches keenly. The decisions made in the coming months will not only influence the immediate future of oil prices but also signal how the alliance plans to address the broader challenges of energy supply, demand, and geopolitical tensions in a rapidly evolving global landscape.

Street Views

- Giacomo Romeo, Jefferies (Neutral on OPEC+ production cuts):

"The decision sends a message of cohesion and confirms that the group in not in a hurry to return supply volumes, supporting the view that when this finally happens, it will be gradual (we expect in 3Q, as demand gets seasonally stronger)."

Finance GPT

beta