Markets Wrap

AI Frenzy Tests Tech Sector's Resilience

By Mackenzie Crow

ᐧ

Key Takeaway

- Tech sector volatility highlighted by significant downturns in Apple, AMD, and Tesla amidst AI frenzy driving speculative market behavior.

- Contrasting views on AI's impact: JPMorgan sees "froth" while Goldman Sachs argues valuations are fundamental-based, indicating a divided outlook on tech boom vs. bubble.

- Market sentiment mixed with Federal Reserve's interest rate stance influencing expectations; cautious investment approach recommended amid speculative AI rally.

Tech Tumult and the AI Frenzy: A Macro Trader's Perspective on U.S. Markets

The U.S. stock market has recently been a battleground of contrasting forces, with the tech sector at the epicenter of volatility and speculation. As a macro trader, it's crucial to dissect these dynamics to understand the broader implications for investors heavily invested in U.S. equities.

The Tech Sector's Roller Coaster Ride

The recent downturn in tech stocks has been a wake-up call for investors who have been riding the wave of seemingly endless growth. Apple Inc., Advanced Micro Devices Inc., and Tesla Inc. have all faced significant setbacks, with issues ranging from iPhone challenges in China to regulatory roadblocks and slumping shipments. This downturn comes after a period of bullish positioning in U.S. technology stocks, with Citigroup Inc.'s Chris Montagu highlighting the "extremely extended" long positioning in Nasdaq 100 futures. Kenny Polcari of SlateStone Wealth encapsulates the sentiment by questioning whether these tech giants can justify their "lofty valuations."

The AI Boom: Bubble or Boom?

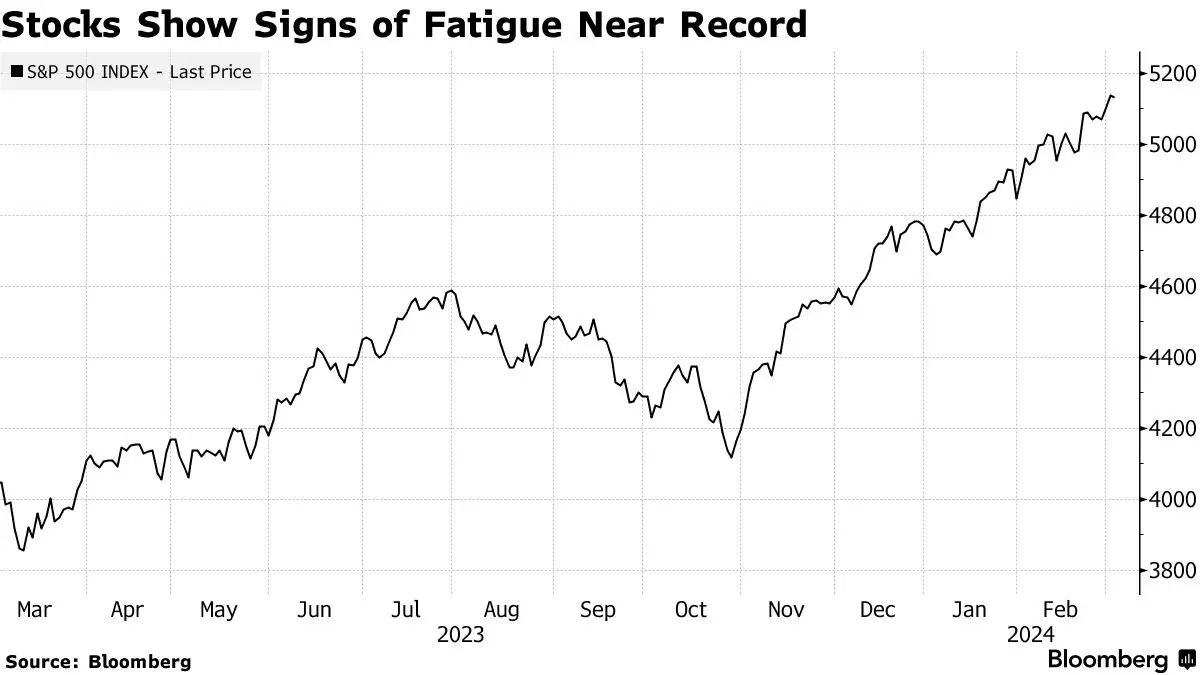

The fervor around artificial intelligence (AI) has been a double-edged sword for the tech sector. On one hand, the "Magnificent Seven" tech giants have propelled the S&P 500 to new heights, partly fueled by the AI frenzy. On the other hand, this rally has sparked debates on whether we're witnessing a tech boom or a bubble. JPMorgan Chase & Co.'s Marko Kolanovic and Goldman Sachs Group Inc.'s David Kostin offer contrasting views, with Kolanovic warning of accumulating froth and Kostin arguing that big tech's valuations are grounded in fundamentals. The AI craze, likened to a "modern gold rush" by Tom Essaye of The Sevens Report, underscores the speculative nature of this rally, with UBS and Truist Advisory Services suggesting a cautious approach to tech exposure.

Market Sentiment and the Fed's Role

The market's reaction to mixed economic data and anticipation of Jerome Powell's testimony to Congress reflects a broader uncertainty. The cooling U.S. service sector, juxtaposed with rising orders and business activity, paints a complex picture of the economy. This uncertainty is further compounded by the Federal Reserve's stance on interest rates, with the market adjusting to expectations of delayed and less significant rate cuts. The AI frenzy and expectations for rate cuts in 2024 have renewed speculative behavior, as noted by the GMO Asset Allocation team, raising concerns about potential disappointments if aggressive growth expectations are not met.

Street Views

Chris Montagu, Citigroup (Neutral on US technology stocks):

"Bullish positioning in US technology stocks is at the highest in three years — raising the risk of a pullback."

Kenny Polcari, SlateStone Wealth (Neutral on megacaps):

"What is starting to concern some investors is whether or not some of these tech companies that have gotten stretched can in fact live up to the ‘lofty valuations’ that investors have placed on them."

Marko Kolanovic, JPMorgan Chase & Co. (Cautiously Optimistic on US equities and Bitcoin):

"The dramatic rally in US equities and Bitcoin signals accumulating froth — conditions that typically precede a bubble when asset prices rise at an unsustainable pace."

David Kostin, Goldman Sachs Group Inc. (Bullish on big tech's valuations):

"Big tech’s lofty valuations are supported by fundamentals."

Tom Essaye, The Sevens Report:

"The AI craze is a modern gold rush... But if AI doesn’t result in increased profitability for the rest of the S&P 500 over the coming years, then demand for AI chips will evaporate as will AI-related cloud demand."

Solita Marcelli, UBS Global Wealth Management:

"While we see further room for the current tech rally to run... investors should review and optimize their exposure to technology to protect against potential declines and benefit from opportunities beyond big tech."

Keith Lerner, Truist Advisory Services:

"Valuations are rich on most metrics but with tech comparative earnings momentum tends to be more important near-term driver. And profit trends remain strong and are at new highs."

Ross Mayfield,Baird:

"Comparisons to the dot-com bubble should be expected given concentration gains in tech sector...But we're not yet close those levels.There's room run"

Gina Martin Adams,Bloomberg Intelligence Strategists:

"Valuations,eaming trends market sentiment all refute speculation an AI-driven has reemerged large caps.Our theme universe shows sales generally supporting price gains..."

Nicholas Colas DataTrek Research:

"While stand argument stocks not bubble,the confluence prospective Fed easing cycle attention-grabbing new does raise risk might form later year into 2025"

Finance GPT

beta