Markets Wrap

Fed's Hawkish View, Tech Troubles Sink Stocks

By Jack Wilson

ᐧ

Key Takeaway

- Hawkish Fed comments and tech sector challenges, including AMD's AI chip sales block in China and Tesla's low shipments, drive U.S. market downturn.

- Market recalibrates expectations with a potential rate cut delayed to mid-year, reflecting strong economic data and Fed's cautious stance.

- Nasdaq significantly impacted by premarket retreats in major tech firms like AMD, Tesla, and Apple due to specific operational hurdles.

Hawkish Fed Sentiments and Tech Woes Drag Down U.S. Markets

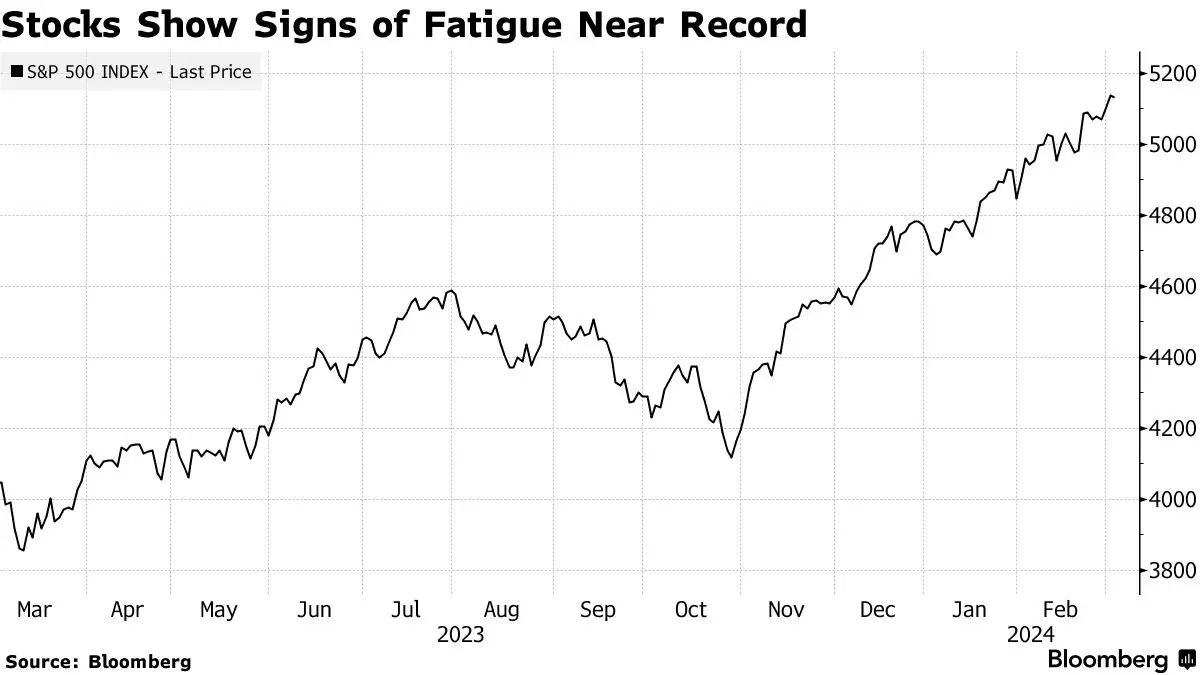

The U.S. stock market faced a downturn as hawkish comments from Federal Reserve policymakers and challenges in the tech sector dampened investor sentiment. The S&P 500 and Nasdaq futures experienced declines, with the latter significantly impacted by premarket retreats in major tech companies such as Advanced Micro Devices Inc., Tesla Inc., and Apple Inc. This downturn reflects the broader market's reaction to the Federal Reserve's stance on interest rates and specific hurdles faced by key players in the technology sector.

Federal Reserve's Stance on Interest Rates

Recent comments from Atlanta Fed President Raphael Bostic have reinforced the notion that the Federal Reserve is not in a hurry to cut interest rates. Bostic's expectation of a single rate cut followed by a pause has led to a recalibration of market expectations, with the first rate cut now anticipated no earlier than mid-year. This cautious approach by the Fed, underscored by strong economic data, has prompted a reevaluation of the likelihood and timing of rate reductions. Societe Generale strategist Kenneth Broux highlighted the market's adjustment, noting the removal of three anticipated Fed cuts in recent months and raising the question of whether further adjustments are necessary.

Challenges in the Tech Sector

The tech-heavy Nasdaq's performance was particularly affected by setbacks for several major companies. AMD faced a significant roadblock with the U.S. government hindering its plans to sell an artificial intelligence chip in China. Tesla's vehicle shipments in China hit a 14-month low, exacerbating concerns over its performance in the crucial Chinese market. Additionally, Apple's iPhone deliveries in China saw a 24% slump in the first six weeks of 2024, further contributing to the sector's woes. [1]

Market Reactions and Investor Sentiment

The market's response to these developments has been mixed, with some investors adopting a cautious stance ahead of Fed Chair Jerome Powell's Congressional testimony and the upcoming monthly payrolls data. The anticipation of Powell's reaffirmation of the Fed's patient approach to rate cuts has added to the market's uncertainty. Meanwhile, the Stoxx 600 index in Europe and Hong Kong equities experienced declines, reflecting global concerns over growth and inflation targets, as well as the effectiveness of China's market-support measures.

Street Views

Kenneth Broux, Societe Generale (Neutral on the market):

"If Bostic wants one cut then a pause, you can’t help but wonder if the Fed is wavering on three cuts. The data is doing the talking and it’s really not screaming for the Fed to cut rates." "We have taken out three Fed cuts in the past two months, so now the question is: do we need to take out more?"

Cameron Crise, Bloomberg (Neutral on US stock operators and EM investors):

"US stock operators are facing the most intense pressure since the start of 2018... For EM investors, though, that’s quite literally a first-world problem."

James Crombie, Bloomberg (Bullish on corporate bond issuance; Bearish/Warning regarding froth in credit markets):

"Record levels of corporate bond issuance at ever-tighter pricing highlight a glut of cash in US credit markets that will only balloon when the Federal Reserve starts easing... Froth creeping back into credit markets bolsters the case for the Fed to hold for longer — and possibly even to hike."

Finance GPT

beta