Macro

Cocoa Prices Soar, Chocolate Costs to Spike

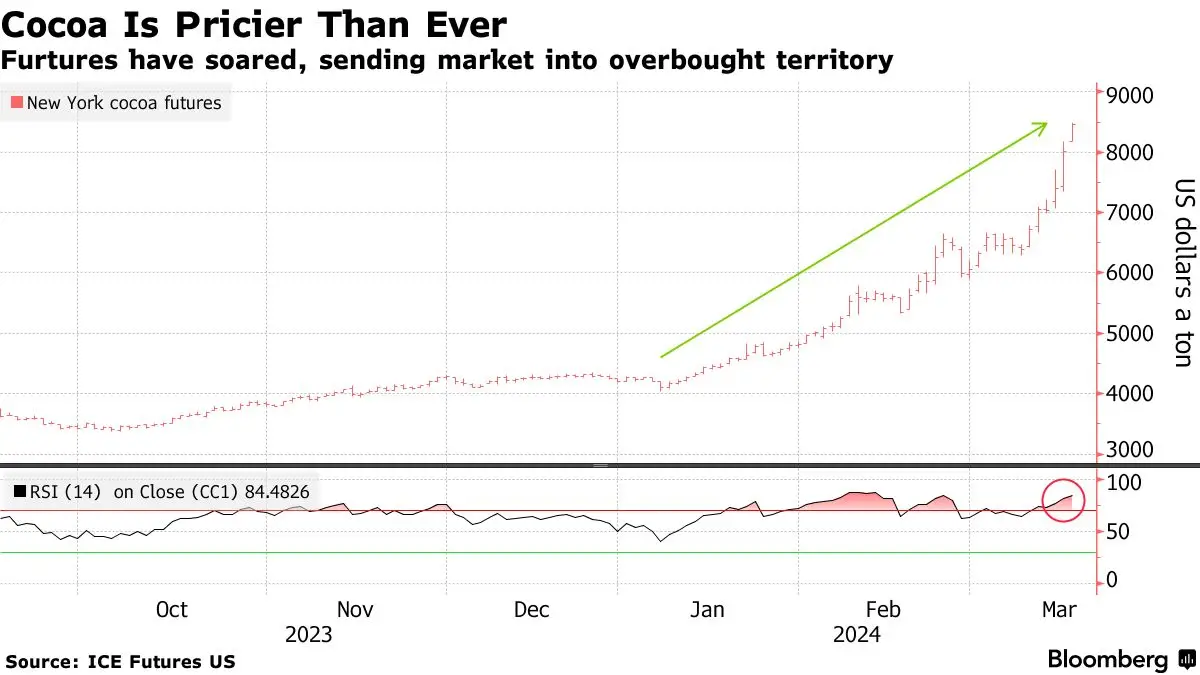

Cocoa prices double in 2023, hitting over $8,400 a ton amid West African harvest woes, driving fears of global shortages.

By Max Weldon

ᐧ

Key Takeaway

- Cocoa prices doubled this year, exceeding $8,400 a ton due to poor harvests in West Africa, signaling higher chocolate costs.

- Futures tripled since last year; Citigroup Inc. suggests prices could hit $10,000 amid worsening supply outlooks.

- Despite cocoa's rally, speculators are exiting; physical buyers likely driving the surge as global production faces third consecutive deficit.

Cocoa's Unprecedented Rally

Cocoa prices have surged to new heights, with futures in New York roughly tripling since the start of last year. The price has already doubled this year, exceeding $8,400 a ton, outpacing other major commodities. This rally is primarily driven by poor harvests in West Africa, the heartland of global cocoa production, which has led to fears of shortages. Citigroup Inc. has even suggested prices could reach as high as $10,000 a ton if the supply outlook worsens. "I don’t think there’s anyone out there who can predict where this train will stop with a straight face, just because of how unprecedented this kind of rally is," said John Goodwin, a senior commodity analyst at ArrowStream Inc.

The Global Cocoa Shortage

The International Cocoa Organization forecasts a third consecutive global deficit this season, with bean arrivals from Ivory Coast ports nearly 30% behind last year's pace. Adverse weather and crop diseases have significantly impacted West African harvests. Barry Callebaut AG, a major chocolatier, has warned of acute cocoa shortages persisting into the next season, expecting a production shortfall of 500,000 metric tons this season and another deficit of 150,000 tons the following season.

Market Dynamics and Speculation

Despite the rally, speculators have been exiting the market, with open interest dropping by about a third from a peak in late January. This suggests that physical buyers, rather than speculators, may be driving prices higher. The market has also seen extreme volatility, with the premium of the May contract over July futures spiking, indicating concerns over near-term supplies. "Cocoa prices continue to reach unprecedented heights, as tight supply and forecasts for large global production deficits have sparked panic buying," The Hightower Report noted.

Impact on Consumers and Industry

For consumers, this could mean higher chocolate prices or smaller bars, as manufacturers may opt for cheaper substitutes like palm oil. The rally could also prompt new products with no cocoa at all. Barry Callebaut AG notes that high prices have not significantly slowed demand, with chocolate makers having less futures protection than usual, indicating a need to buy more. The supply shortfall is far greater than the demand destruction seen so far, suggesting prices could remain high.

Street Views

- John Goodwin, ArrowStream Inc. (Neutral on cocoa market):

"I don’t think there’s anyone out there who can predict where this train will stop with a straight face, just because of how unprecedented this kind of rally is."

Finance GPT

beta