Macro

Cocoa Price Surge Hits Easter Chocolate, Manufacturers Warn

Cocoa prices double in 2023, driving global chocolate prices up amid shifting monetary policies and inflationary pressures.

By Athena Xu

ᐧ

Key Takeaway

- Cocoa prices have more than doubled in 2023, driving up the cost of chocolate eggs and bunnies for Easter.

- Record cocoa surge due to poor harvests in Ivory Coast and Ghana, impacting global production and leading to "shrinkflation."

- Major chocolate manufacturers like Lindt & Sprüngli, Mondelez International Inc., Hershey Co., and Nestle SA signal price hikes ahead.

Cocoa Prices Skyrocket

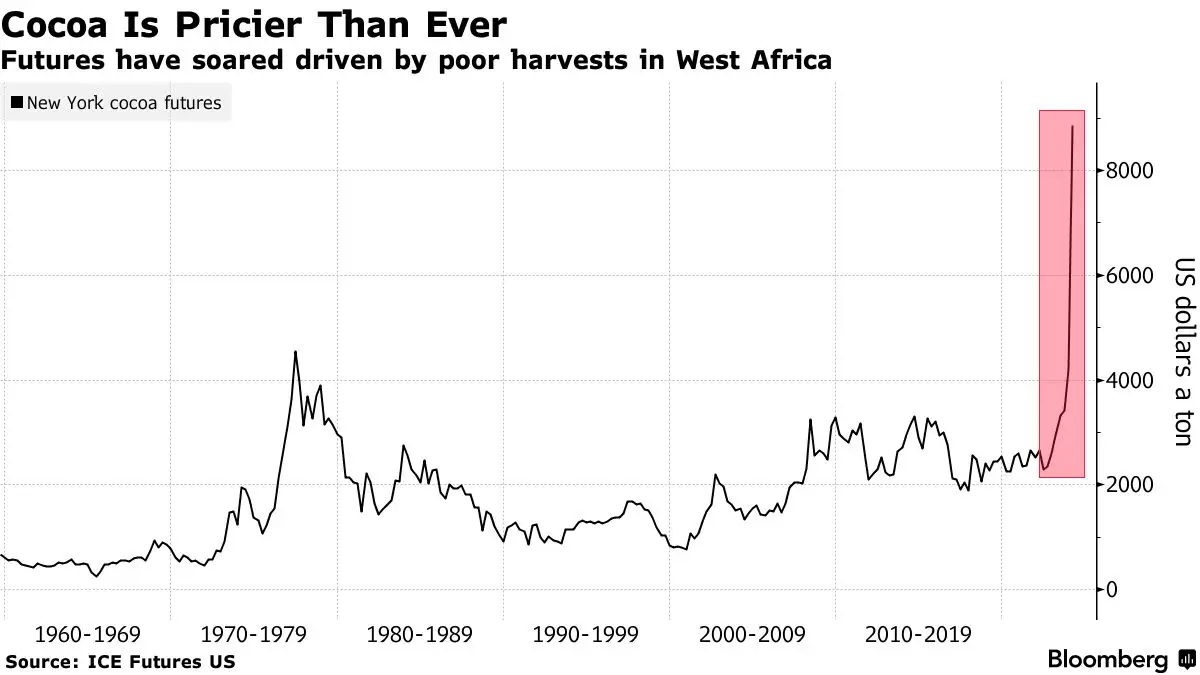

Cocoa has become the world's hottest commodity in 2023, with prices more than doubling already this year. The wholesale beans in New York have surged over 47% in the last three weeks alone, exceeding $8,900 a ton. This unprecedented rally is primarily driven by disappointing harvests in West Africa, particularly in Ivory Coast and Ghana, which are the largest cocoa producers globally. The industry's reliance on smallholder farmers, who have historically received poor returns, exacerbates the situation, making it difficult for them to invest in their farms or cope with extreme weather events.

Emily Stone, founder of specialty cocoa dealer Uncommon Cacao, remarked, “The true cost of chocolate has not been seen by consumers for a long time... Now, that comes as a shock to some, but this was predictable.” This surge in cocoa prices is a stark reminder that, despite easing headline inflation rates globally, spikes in individual commodities can still significantly impact consumers.

Impact on Consumers and Markets

The ripple effects of the cocoa price surge are being felt by consumers worldwide, with chocolate prices soaring. In the UK, the cost of some popular Easter eggs has increased by up to 50%, and in the US, the average unit price of chocolate eggs is up 12% over the past year. This phenomenon of "shrinkflation," where consumers pay more for less, is becoming increasingly common. In Brazil, the situation has turned into an internet meme, with stores advertising chocolate eggs available for purchase through loans and payment installments.

Confectionery companies are also feeling the pinch. Swiss chocolate maker Lindt & Sprüngli announced plans to raise prices this year and next due to the jump in raw material costs. Other major manufacturers like Mondelez International Inc., Hershey Co., and Nestle SA have signaled potential price increases to cover the inflation in cocoa prices.

Global Inflation and Monetary Policy Shifts

As cocoa prices soar, the broader economic landscape is showing signs of a shift in inflation and monetary policy. Central banks across major economies, including the Federal Reserve, European Central Bank, and the Swiss National Bank, are moving towards easing monetary policies as the once-in-a-generation cost-of-living shock subsides. This pivot towards lower interest rates reflects a growing confidence among policymakers that the inflationary pressures of the post-pandemic era are being tamed.

However, the surge in cocoa prices serves as a reminder that specific sectors can still experience significant inflationary pressures, even as the overall inflation rate declines. This situation poses challenges for central banks as they navigate the path towards economic recovery and stability.

Street Views

Emily Stone, founder of Uncommon Cacao (Neutral on cocoa prices):

"The true cost of chocolate has not been seen by consumers for a long time. Persistent low prices to producers and climate change are driving the market up to these heights. Now, that comes as a shock to some, but this was predictable."

Judy Ganes, president of J Ganes Consulting (Neutral on chocolate pricing strategy):

"If you push through a price increase now, then you can sustain operations and not have to make a short jump."

Management Quotes

Luca Zaramella, CFO of Mondelez International Inc.:

"[Price increases] are likely."

Michele Buck, CEO of Hershey Co.:

"We remain committed to pricing to cover inflation."

Nestle SA statement:

"While it’s absorbed some higher costs through efficiencies... may need to make responsible adjustments to pricing in the future given the persistently high cocoa prices."

Finance GPT

beta