Equities

Alphabet, Chipotle Overbought, Market Eyes Gains

Alphabet and Chipotle lead as overbought stocks amid market's recovery, with tech and consumer sectors showing mixed results.

By Bill Bullington

ᐧ

Key Takeaway

- Alphabet and Chipotle hit 52-week highs, labeled overbought with RSIs of 75 and strong earnings driving their stock prices up.

- Market sentiment shifted positively by week's end, influenced by tech earnings; Dow Jones, S&P 500, and Nasdaq poised for gains.

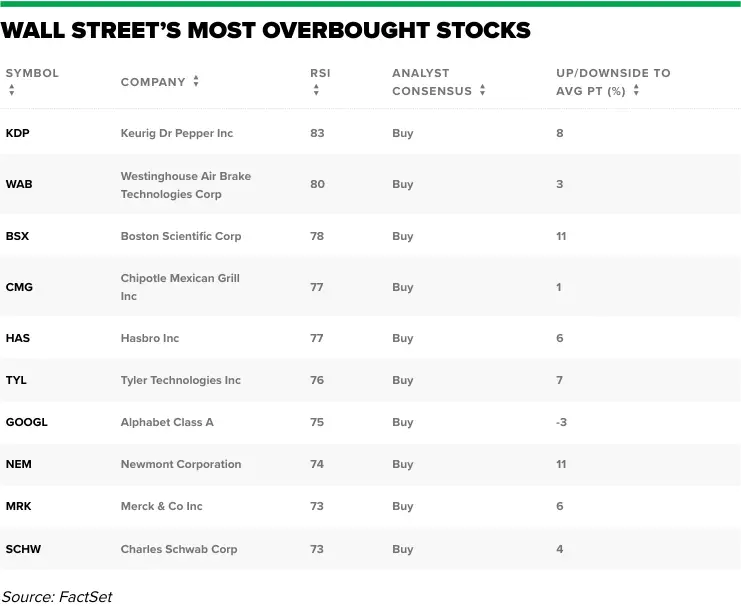

- Overbought stocks like Keurig Dr Pepper (RSI of 83) suggest potential downturns; oversold stocks such as Juniper Networks (RSI of 18) hint at rebounds.

Market Dynamics Shift

Investors navigated a complex landscape this week, marked by a mix of economic data and a barrage of earnings reports. The week saw a significant shift in market sentiment, beginning with a downturn as the U.S. gross domestic product (GDP) for the first quarter fell short of expectations, leading to a decline in major stock indexes on Thursday. However, the mood on Wall Street took a positive turn by Friday, buoyed by strong earnings reports from tech giants Microsoft and Alphabet. This turnaround put the three major stock averages—the Dow Jones Industrial Average, the S&P 500, and the Nasdaq—on track for a winning week, despite the initial setback.

Overbought and Oversold Stocks

Amidst the market's fluctuations, CNBC Pro's stock screener tool highlighted the most overbought and oversold stocks, providing investors with insights into potential market movements. Stocks with a 14-day relative strength index (RSI) above 70, such as Keurig Dr Pepper Inc (RSI of 83) and Westinghouse Air Brake Technologies Corp (RSI of 80), were identified as overbought, suggesting a possible downturn. Conversely, stocks with an RSI below 30, like Juniper Networks Inc (RSI of 18) and International Business Machines Corp (RSI of 19), were deemed oversold, indicating a potential rebound. Alphabet, with an RSI of 75, was among the overbought, despite a consensus buy rating from analysts who foresee a slight average decline of 3%.

Earnings Highlights

The earnings season brought significant developments, with Alphabet announcing its first-ever dividend following a first-quarter earnings and revenue beat, driven by strong performance in Google Cloud and YouTube advertising. This news propelled Alphabet's shares up by more than 10% on Friday. Similarly, Chipotle Mexican Grill reported first-quarter earnings and revenue that exceeded expectations, leading to a 52-week high in its stock price. The company's success is attributed to strong customer traffic despite increased menu prices. On the other hand, Hasbro, with an RSI of 77, saw its shares rise by 26% in 2024, buoyed by a better-than-expected earnings report, although parts of its business still faced challenges.

Sector-Specific Movements and Tech Tensions

The pre-market trading session revealed sector-specific movements, with technology stocks facing pressure due to Meta Platforms Inc.'s disappointing outlook. Arista Networks (ANET) and Ford (F) defied the tech downtrend, with ANET shares rising by 3.2% and Ford shares increasing by 2% following positive earnings reports. The consumer sector saw mixed results, with Chipotle (CMG) gaining 3.5% after strong quarterly results, while Monster (MNST) shares fell by 3% after receiving a sell-equivalent rating. In the energy sector, Valero Energy (VLO) outperformed expectations, contributing to the market's positive momentum.

Street Views

- Ashley Helgans, Jefferies (Neutral on Ulta Beauty):

"We have viewed Ulta as a share taker in current macro, but see constraints on ULTA’s prestige biz (50% sales) due to lack of newness and increasing pressure from Sephora which raises the potential for downward revisions in the [next 12 months]."

Finance GPT

beta