Macro

Dividend Stocks to Shine, BoA Lists Top Picks

Bank of America sees dividend stocks leading in recovery, highlighting secure, above-market yields in sectors like utilities and energy.

By Max Weldon

ᐧ

Key Takeaway

- Bank of America highlights dividend stocks as poised for outperformance, citing a favorable U.S. economic recovery phase.

- Recommended stocks include Southern Copper, AES Corporation, and Citigroup with dividends ranging from 3.1% to 4%, showing varied YTD performance.

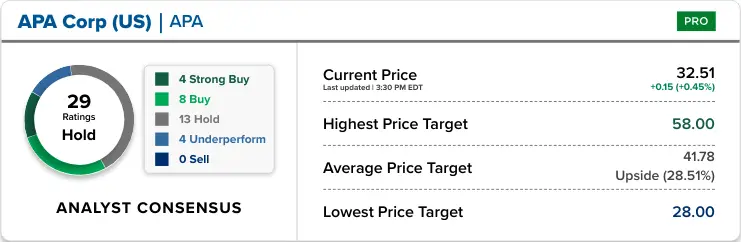

- Utilities and energy sectors are emphasized for their stable dividends, with specific mentions of Sempra and APA Corporation despite recent underperformance.

Dividend Stocks Shine in Recovery Phase

Bank of America's U.S. Regime Indicator has shown the largest increase since July 2021, moving into a recovery phase in February. This shift signals a favorable environment for dividend stocks, particularly those with above-market yields that are secure and not stretched. Equity and quant strategist Savita Subramanian from Bank of America highlights that "High Div Yield has led 88% of the time during prior Recoveries," suggesting a strong potential for income investors, especially if the Federal Reserve begins to cut rates. This environment underscores the attractiveness of dividend stocks in the current economic recovery phase.

Selecting High-Yield Dividend Stocks

Bank of America's analysis points investors towards quintile two of the Russell 1000 by trailing dividend yield for secure, above-market yields. This strategy aims to avoid distressed companies that might move into the highest dividend yield group ahead of potential dividend cuts. Notable names on Bank of America’s list include Southern Copper Corporation, AES Corporation, Vail Resorts, HP Inc., Campbell Soup, Citigroup, APA Corporation, HF Sinclair, and Sempra. These companies span various sectors, offering a diversified approach to investing in dividend stocks during the recovery phase.

Utilities and Energy Stocks in Focus

Utilities like AES and Sempra, yielding 4% and 3.5% respectively, are highlighted for their predictable dividends despite lagging the overall market this year. Sempra's CEO Jeffrey Martin's announcement of a $48 billion capital plan for grid modernization and renewable integration underscores the growth potential in utilities. Energy stocks such as APA and HF Sinclair also make the list, with APA announcing a significant acquisition to bolster its position in the Permian Basin. Citigroup is noted among financials, with a 22% increase in shares year-to-date, showcasing the potential in diverse sectors for dividend investing.

Analysts Advocate for Defensive Stocks Amid Market Downturn

With the recent market pullback and concerns over a more pronounced downturn, CNBC Pro identifies S&P 500 stocks with over 4% dividend yield and at least 10% EPS growth as defensive plays. Stocks like Ventas, Host Hotels & Resorts, and AT&T are spotlighted for their potential upside and defensive characteristics. Goldman Sachs and Bloomberg's analysis further supports the strategy of focusing on stocks with promising profit growth and high return on equity (ROE) as a measure of profitability, highlighting the importance of selective investment in a nuanced market landscape.

Street Views

- Savita Subramanian, Bank of America (Bullish on dividend stocks):

"High Div Yield has led 88% of the time during prior Recoveries. This factor remains inexpensive and neglected as well … and could be a beneficiary of income investors’ flows if the Fed begins to cut rates."

Management Quotes

Jeffrey Martin, CEO of Sempra:

"A $48 billion record capital plan really lays out a roadmap for our future growth and should support rate-based growth at our utilities at between 9% and 10%."

John Christmann, CEO of APA:

"The deal adds to APA’s 'backbone' in the U.S.’s Permian Basin."

Finance GPT

beta