Macro

Early Bets on Treasurys Surge Ahead of Economic Reports

Traders adopt pre-dawn strategies, betting on economic forecasts with a mix of confidence and caution amidst market volatility.

By Max Weldon

ᐧ

Key Takeaway

- Bond traders are making early bets on U.S. Treasurys ahead of key economic reports, reflecting confidence in predicting market shifts.

- Advanced trading now starts up to six hours before data releases, a significant shift from previous patterns concentrated just before announcements.

- Despite the risks of early positioning, sophisticated analysis tools and AI are enabling more accurate predictions, though surprises remain possible.

Navigating the Pre-Dawn Market: The New Norm in Trading Strategy

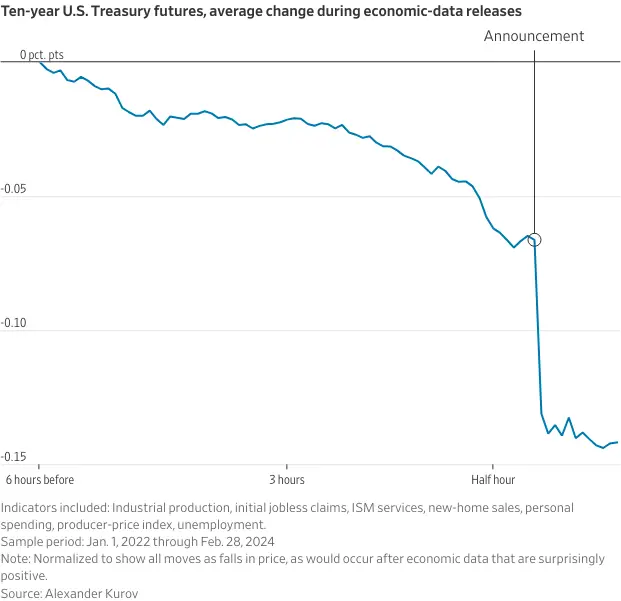

In the shadowy hours before the dawn of major U.S. economic announcements, a new breed of traders is making bold moves, armed with predictions and a belief in their ability to foresee the Federal Reserve's next steps. This emerging trend, highlighted by Alexander Kurov, a finance professor at West Virginia University, reveals a significant shift in trading behavior. Kurov's analysis points out that bond futures exhibit a notable change of 0.14 percentage point around seven key economic releases, with almost half of this adjustment happening up to six hours before the official data hits the newsstands. This pivot from last-minute gambles to pre-emptive strikes is a testament to traders' growing conviction in their forecasting prowess and their ability to navigate the market's future trajectory.

The Double-Edged Sword of Preemptive Trading

The allure of getting ahead in the game, however, comes with its own set of challenges. The strategy of placing early bets, while reflective of traders' confidence, injects a dose of volatility and risk into the financial markets. The 10-year Treasury yield, for instance, has been on a rollercoaster ride, with its daily fluctuations tied to traders' anticipations of economic data. The real test, however, is not just in predicting the numbers accurately but in weaving these predictions into a coherent economic narrative. The market has witnessed its fair share of abrupt corrections, such as the instance when bond yields surged in anticipation of the personal-consumption expenditures price index release, only to retreat when the actual data aligned with expectations. Despite the inherent risks, the lure of advanced analytical tools and artificial intelligence has emboldened traders to place their bets early, in an attempt to outpace the market.

Steering Through Uncertainty: A Word of Caution

While traders have found some success in predicting the market's response to indicators like jobless claims, the road becomes murkier when it comes to forecasting pivotal reports such as nonfarm payrolls and the consumer-price index. These indicators, crucial for gauging potential shifts in interest rates, are fraught with unpredictability. The challenge is compounded by the economic upheaval ushered in by the pandemic, reminding traders that overconfidence can lead to unforeseen pitfalls. Chris McAlister, global head of derivatives trading at Prudential, underscores this sentiment, pointing out the Fed's reliance on volatile and complex data. McAlister's cautionary note serves as a reminder that the journey of interest rates is fraught with complexities, urging traders to tread carefully and not to be swayed by the illusion of certainty.

In the evolving landscape of U.S. equities and sectors, the shift towards early trading based on economic forecasts represents a significant transformation in market dynamics. As traders navigate this new terrain, armed with sophisticated tools and a wealth of data, the balance between confidence and caution has never been more critical. The pursuit of preemptive gains, while promising, demands a nuanced understanding of the market's undercurrents and the humility to acknowledge the unpredictable nature of economic indicators. As the market continues to evolve, so too must the strategies of those who seek to master it.

Street Views

Alexander Kurov, West Virginia University (Neutral on bond market trends):

"The price drift starts much earlier than we found in our previous research. Traders know if they start betting five minutes before an announcement, it’s kind of too late."

Lundy Wright, Weiss Multi-Strategy Advisers (Neutral on the difficulty of anticipating market moves):

"Trying to anticipate a move is still no easy task... Even when traders think they know what the data will show, they also have to consider whether that aligns with their overall view of the economy." "We monitor who has the hot hands—what forecasters have the best predictability over the past three and six months. It’s sort of like betting alongside a betting expert."

Chris McAlister, Prudential (Cautiously Optimistic about Fed's data dependency):

"The Fed has been data-dependent many times, but I don’t think the data has ever been as difficult and volatile for them to read."

Finance GPT

beta