Macro

Gold Hits Record $2,149 Amid Economic Fears, Fed Watch

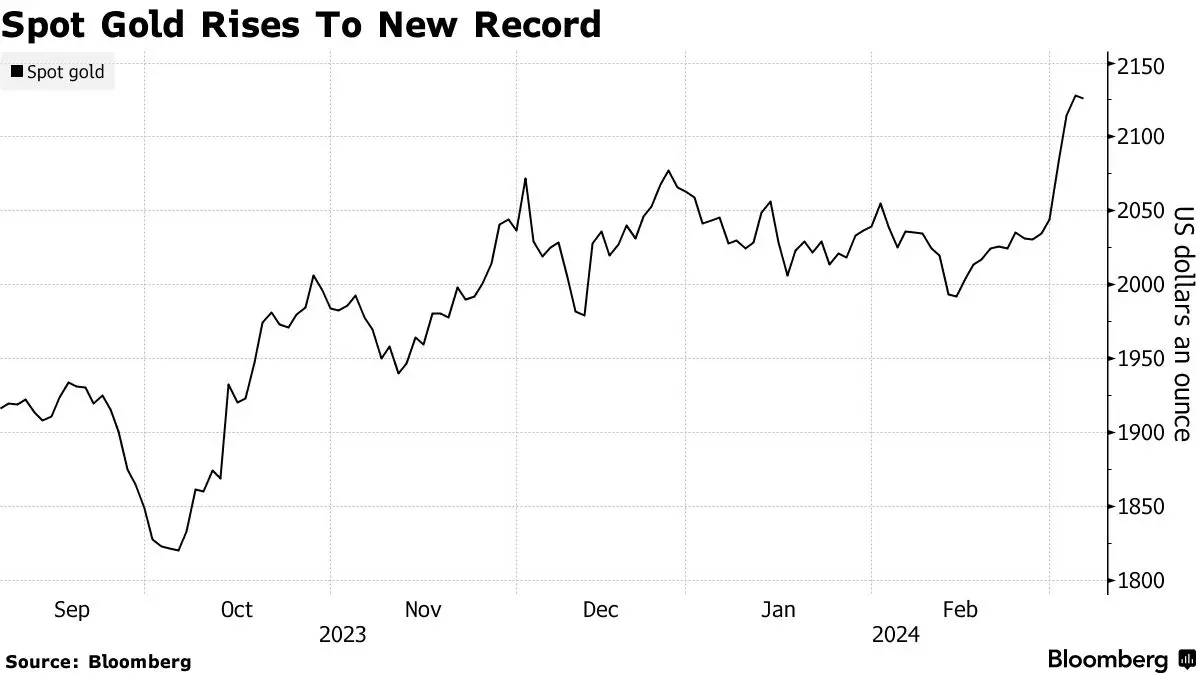

Gold hits record high amid US economic concerns, with a 5% increase and strong Chinese demand, despite ETF holdings drop.

By Barry Stearns

ᐧ

Key Takeaway

- Gold hits a new record of $2,149.25/oz, driven by weak US data, banking concerns, and anticipation of Fed rate cuts.

- Technical indicators suggest gold may be overbought; next significant resistance at $2,163.

- Chinese demand for gold surges as consumers seek hedges against market turmoil; central banks continue to stockpile.

Gold's Record Surge

Gold prices surged to a record high this week, driven by weak US economic data and banking concerns, resulting in a 5% increase over the past four trading sessions. The rapid and substantial rise in bullion prices caught many analysts off guard, especially given the absence of significant changes in the Federal Reserve's rate-cutting outlook, which has been a focal point for the market.

Favorable Backdrop and Demand Drivers

The surge in gold prices is occurring against a backdrop of heightened geopolitical tensions, making the precious metal an attractive safe-haven asset. Gold's performance over the past year has been surprising, with prices remaining elevated despite rising real interest rates. Central bank buying and strong demand from Chinese consumers have also supported gold prices, despite the typical inverse relationship with bond yields.

Key Charts to Monitor

- Real Yields: The anticipation of the Fed's rate cuts has been a significant driver of gold prices. While Fed Chair Jerome Powell has indicated a cautious approach to rate cuts, the market is pricing in a 65% chance of a cut in June.

- Technical Indicators: Gold broke through resistance levels to reach a fresh record of $2,149.25 an ounce. Analysts suggest that the precious metal may be overbought at current levels, triggering technical and momentum trades.

- Gold Futures Open Interest: Money managers have been adding fresh long positions in gold, fueling the price rally. This increase in open interest indicates growing bullish sentiment among investors.

- Chinese Buying: Chinese demand for gold has surged, with Swiss exports to China nearly tripling in January. Chinese consumers are seeking a hedge against market turmoil, while the country's central bank is also increasing its gold reserves to reduce reliance on the dollar.

- ETF Disconnect: Gold-backed exchange-traded funds have been reducing their holdings for seven consecutive months, despite central bank demand for the precious metal. Analysts anticipate that ETF holdings may stabilize, providing further support to gold prices.

Street Views

Jerome Powell, Fed Chair (Neutral on interest rate cuts and inflation):

"The US central bank is in no rush to cut interest rates until policymakers are convinced they have won their battle over inflation."

Rhona O’Connell, StoneX Financial Ltd. (Neutral on gold's current price):

"Gold is already overbought above $2,115. The weak US numbers at the end of last week triggered technical and momentum trades, plus a 'bandwagon effect.'"

James Steel, HSBC Holdings Plc (Bullish on gold-backed ETFs):

"Those ETF holdings are likely to stabilize. That could add further momentum to bullion."

Finance GPT

beta