Macro

S&P Error Triggers Unusual Bank Stock Swings

S&P's error causes unusual trading in Morgan Stanley, PNC, impacting stock prices and volumes due to wrongful index inclusion.

By Max Weldon

ᐧ

Key Takeaway

- S&P Global's error mistakenly included Morgan Stanley, PNC, and Northern Trust in a high dividend-yielding index, causing unusual stock swings.

- Corrected information was released on March 5, after stocks experienced significant volume and price changes due to the mistake.

- Index rebalancing can significantly impact trading liquidity and company profiles; this incident highlights the sensitivity of markets to such adjustments.

S&P Global Blunder Impacts US Banks

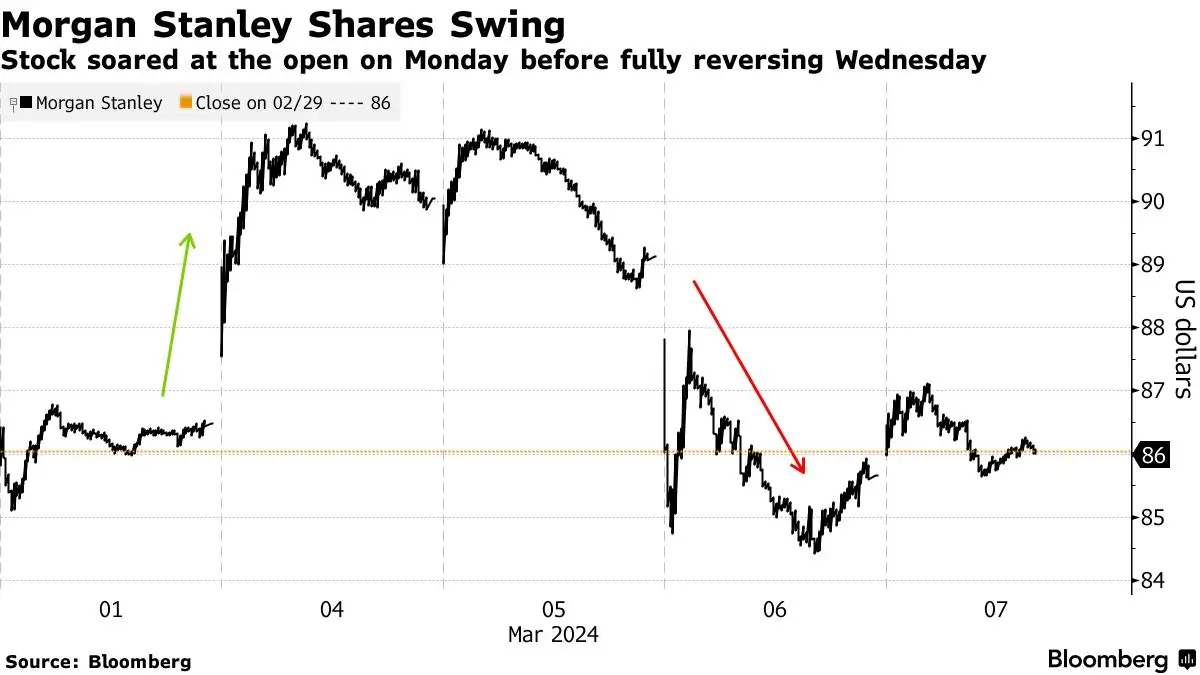

Shares of major US banks, including Morgan Stanley, PNC Financial Services Group Inc., and Northern Trust Corp., experienced significant price and volume fluctuations following a rare processing error by S&P Global. The error involved the inclusion of these banks, along with other financial firms, in the Dow Jones U.S. Dividend 100 Index, which tracks high dividend-yielding stocks. However, these banks were not supposed to be part of the index, leading to a correction by S&P on Tuesday to remove them from the list.

Market Reaction and Trading Activity

Morgan Stanley and PNC witnessed stock price swings and a surge in trading volumes on both Monday and Wednesday, with volumes exceeding double their daily average over the last five years. By mid-day trading on Thursday, Northern Trust emerged as the top gainer in the KBW Bank Index, while Morgan Stanley saw a slight increase in its stock price. The banks' inadvertent inclusion in the index likely prompted some funds using it as a benchmark to add those shares, resulting in increased trading activity.

Impact on Index Composition and Market Trends

Indexes like the Dow Jones U.S. Dividend 100 undergo regular rebalancing to ensure they reflect market trends and meet specific criteria. Inclusion in such equity indexes can enhance a company's visibility and trading liquidity. The annual reconstitution process for this index occurs in March, with preliminary results circulated to market participants for feedback before changes take effect. The index has returned 2.04% year-to-date through Feb. 29, comprising 100 companies with a significant representation from industrial, healthcare, and financial sectors.

Finance GPT

beta